Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

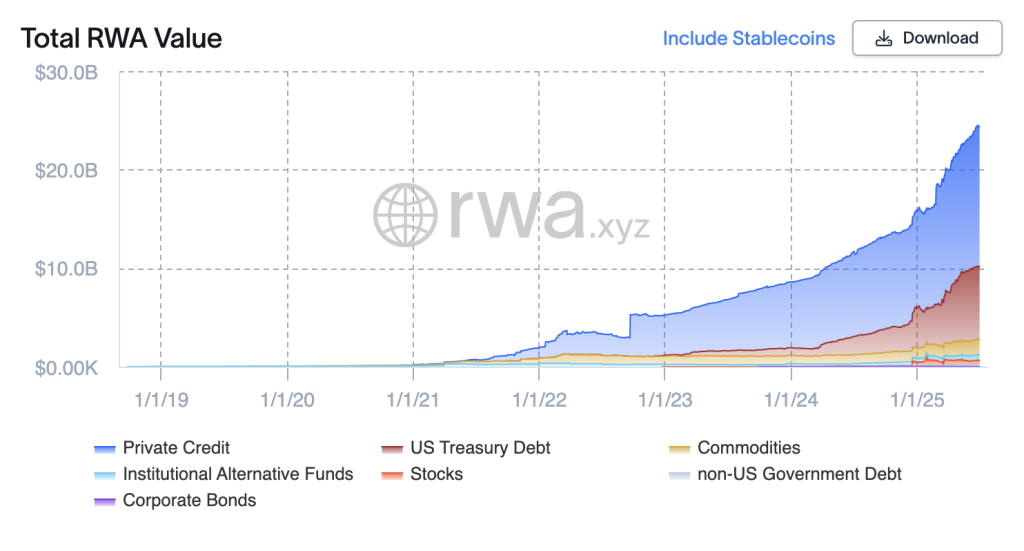

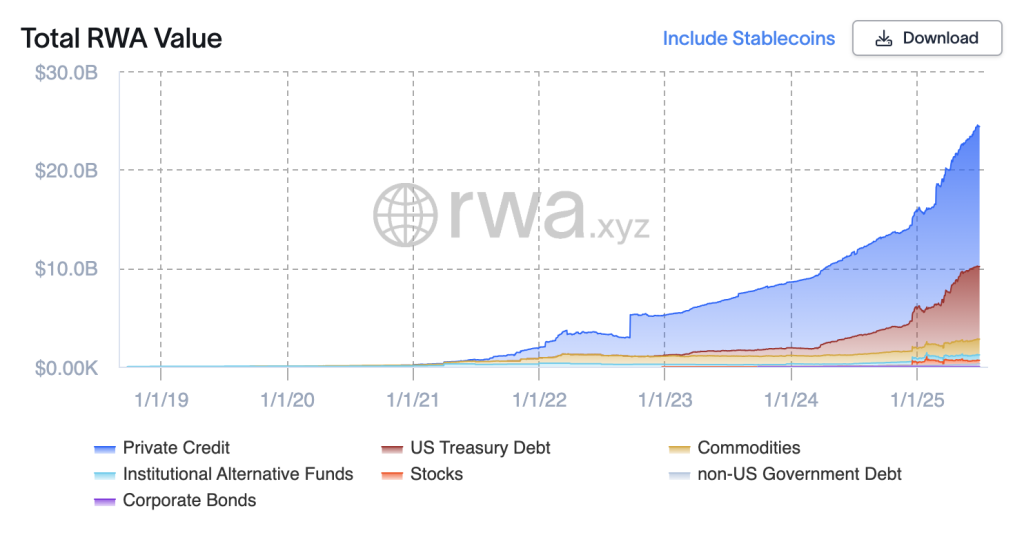

Asset in the real world (RWA) Tokens became a favorite story of blockchain from 2025. Treasures, real estate, even barrels of whiskey – around $ 24 billion Worth – now sitting on public books.

The value of the on-line really grows fast, but what is still missing under it. Legal uncertainty, technical narrow places and sequence places in custody – any of them could bring the entire experiment to blocking.

Given that billions are already following the chain and institutional players, the tokenization has shifted behind the theory, but its foundations are still fragile. If we do not repair the foundations, the momentum could stop before this thing really takes off. Who owns what? How does the system speak alone? And is there someone really holding a real asset?

Let’s analyze the three biggest challenges that the sector is back and what we have to happen if we want this $ 24 billion market to mean something more than another “flash-in-the-pane” crypto.

The largest blind point in the tokenization boom is also the most basic: the token is not ownership, it is the entitlement to ownership that matters only if the legal system agrees.

In several outlook jurisdictions such as Luxembourg, digital securities Now you have a legal statusBut most of the world still consider tokens on the chain as representation, not rights. Trust can have a background link or property and the token becomes digital. It’s elegant on paper. In court? Is not guaranteed.

In bankruptcy, the judge could treat the tokenized bond as well as any other unsecured claim and put it into the estate without a special priority. Even on the main markets are the registry systems for assets or securities still paper -basedWhich means there is no pure way to align digital claims with the real world. When it comes to cross -border operations, the problem is getting worse. For enforcement, it depends on contradictory legal doctrines, not about code.

In this situation, I am sure that the regulators should create harmonized definitions of digital assets that are transmissible across borders and enforceable in court. Until this happens, the tokenization remains fragile. So far, we give the financial infrastructure a neat new front-end-on, which is still relying on the trust of the Old World.

Even where the law is not an obstacle, technology is still. Tokenized assets move in infrastructure that has never been designed to interact, and shows it.

Ethereum It remains the main center, but it is rarely the cheapest or most effective. Transactions can cost several dollars per piece, and while layer-2 solutions, such as Arbitrum Help, are other problems. Which one? The liquidity is fragmented, the bridging adds a risk, and users must manage a separate environment that does not speak purely.

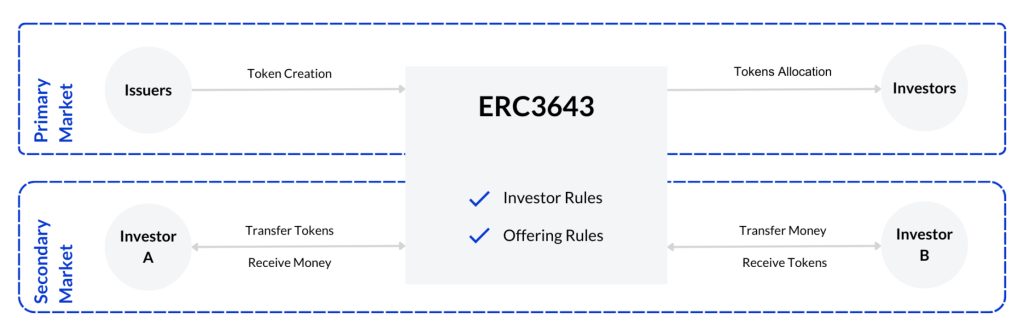

Compliance is just as broken. Most token issuers operate their own permits systems – who can accommodate the token who can apply it and according to what rules. This means that even if your wallet has gone through Kyc for one asset, it may have to go through the process again for another. The result is a discontinuous market where every interaction of the on-board becomes a new event on board.

What would it change? Shared rails, as ERC-3643If they are accepted wide and aligned with regulation, they are a viable way forward. Otherwise, we only rebuild hereditary silo with more elegant tools.

Tokenization can be digital, but is still heavily loaded on offline facts. Each token tied to custody, property or stock needs someone (or something) to verify that the asset is real and still where it is to be. There are things unclear.

Oracles feeds external data in intelligent contracts: prices, changes in ownership and payment. But these sources may be lagging or fail, and intelligent contracts have no idea what is happening outside the chain. If the update is too late or incorrect, the return payments can freeze or omit and on volatile markets, even low delays will be manifested by outdated data in the actual obligations.

The composition in turn brings its own risks. You can hold the tokens, but someone else holds an asset in the real world. If this depository lacks transparency, proper audit or legal liability, the token becomes a digital confirmation without evidence. In addition to well -regulated trusted banks, the standards of links are everywhere, and investors often have no idea what protection if it exists.

To correct it, tokenized markets need evidence of real -time reserves, stronger Oracle standards and administrators who are transparent, responsible and auditable. Some infrastructure already exists.

From my point of view, the tokenization is already shown – in controlled pilots, closed systems and quarantine introduction. But this is not how the financial infrastructure changes. Without legal alignment and shared rails, the railway compliance risk this space risk that patchwork “gated” courses will remain.

I’m not watching another Flashy Protocol. I am currently monitoring convergence – legislators who clearly define digital ownership, and platforms that will no longer rediscover Kyc from scratch.

Responding to responsibility: Opinions in this article are their own writer and do not necessarily present opinions on kryptonews.com. The purpose of this article is to provide a wide view of its topic and should not be considered a professional advice.

Contribution Tokening hype is real – as well as three gaps that could stop him He appeared for the first time Cryptonews.