Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

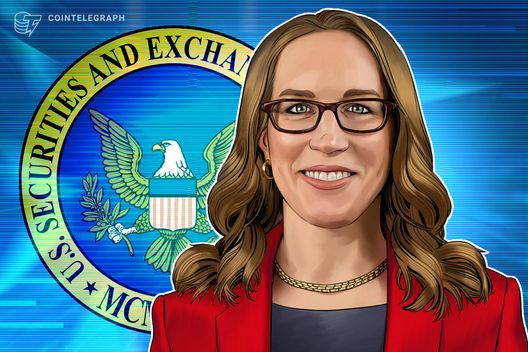

Member of the US Securities and Stock Exchange Commission (sec) Hester Peirce has issued a blanket for companies regarding the distribution and trading of tokenized securities.

At the center of the statement, Peirce called to discuss companies about their potential tokenized offers with SEC officials in the middle of “new participants and many traditional companies […] Receiving onchain products. ”

Although the Sec Commissioner, who also leads the crypto working group of the agency, did not explicitly mention the trading platform Robinhood, its announcement came about two weeks after the company triggered a tokenization layer-2 Blockchain.

“The as powerful as blockchain technology is, it has no magical ability to transform the nature of the basic asset,” Peirce said. “Tokenized securities are still securities. In accordance with this, the market participants must consider – and adhere to the federal laws on securities.”

Peirce’s notes reflected the remarks of the former chairman of Sec Gary Gensler, who often called to the company Since they offer crypto related products that could be considered securities to “come and talk” to officials. However, the US financial regulatory body proposed that the inauguration of US President Donald Trump and the confirmation of Sec Chairman Paul Atkins was moving in a new direction for the crypto industry.

Related: Robinhood shares are approaching a record high because the tokenization strategy is gaining traction

Robinhood strategy would allow the platform to offer investors in Europe tokenized stocks and stock market products. Society seemed to have also been aware of the possible impact on US securities laws, allegedly submitting a proposal On the SEC for the regulation of tokenized assets in the real world in May.

“When unique aspects of technological guarantee change in existing rules or where the regulatory requirements are obsolete or unnecessary, we are ready to cooperate with the market participants to create suitable exceptions and modernize the rules,” Peirce said.

https://www.youtube.com/watch?v=tyo993T72MS

Republican legislators in the US House of Representatives announced that they planned to move forward With regard to the draft Act on the determination of clear regulatory rules of the road for digital assets.

The framework of the market crypto structure under the proposed Act on Digital Asset market could clarify the roles that the Commodity Futures (CFTC) commission (CFTC) could be able to regulate in the US.

Magazine: Inside 30,000 Party Boot Boots to steal crypto AirDrops from real users