Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

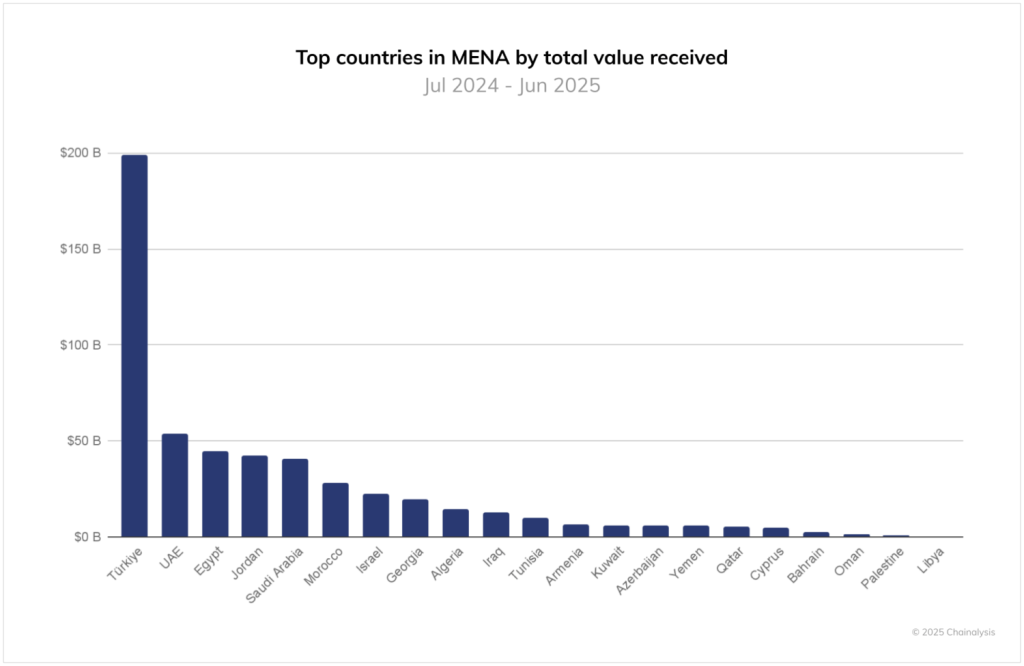

Turkey has become the largest cryptocurrency market in the Middle East and North Africa, recording nearly $200 billion in annual transactions, according to new data from Chainalysis.

The country’s volume surpasses all others in the region, almost four times that of the United Arab Emirates (UAE), which is in second place at $53 billion.

Despite the surge, analysts warn that much of Turkey’s crypto activity appears to be driven by speculative trading rather than sustainable adoption.

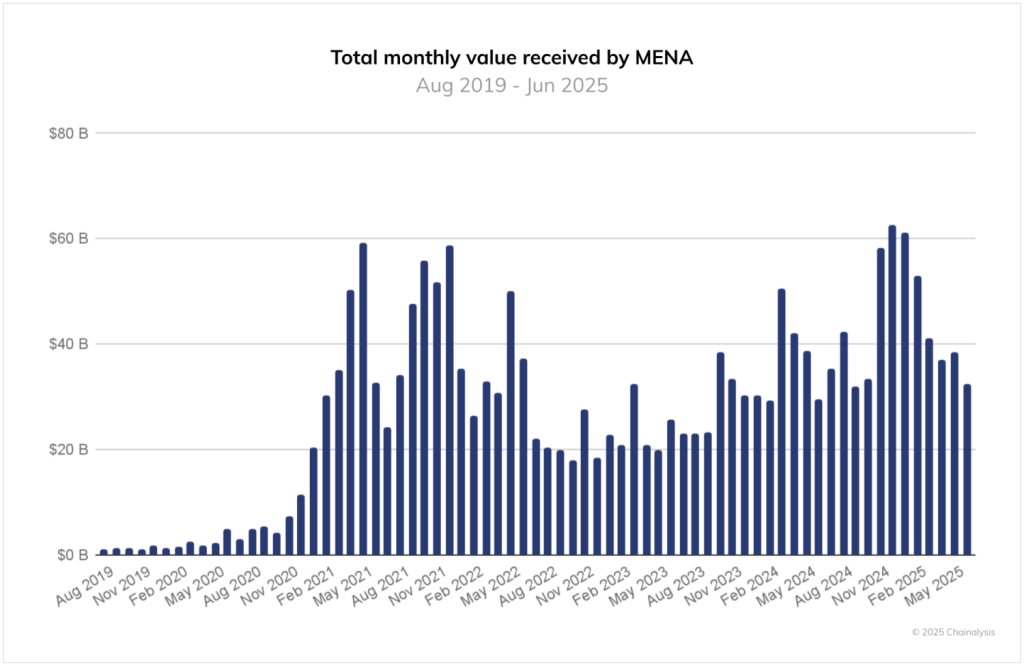

Chainalysis 2025 Crypto Adoption Report shows Turkey’s growing influence in the MENA region, where total crypto transaction volumes reached more than $60 billion in December 2024, before easing slightly in 2025.

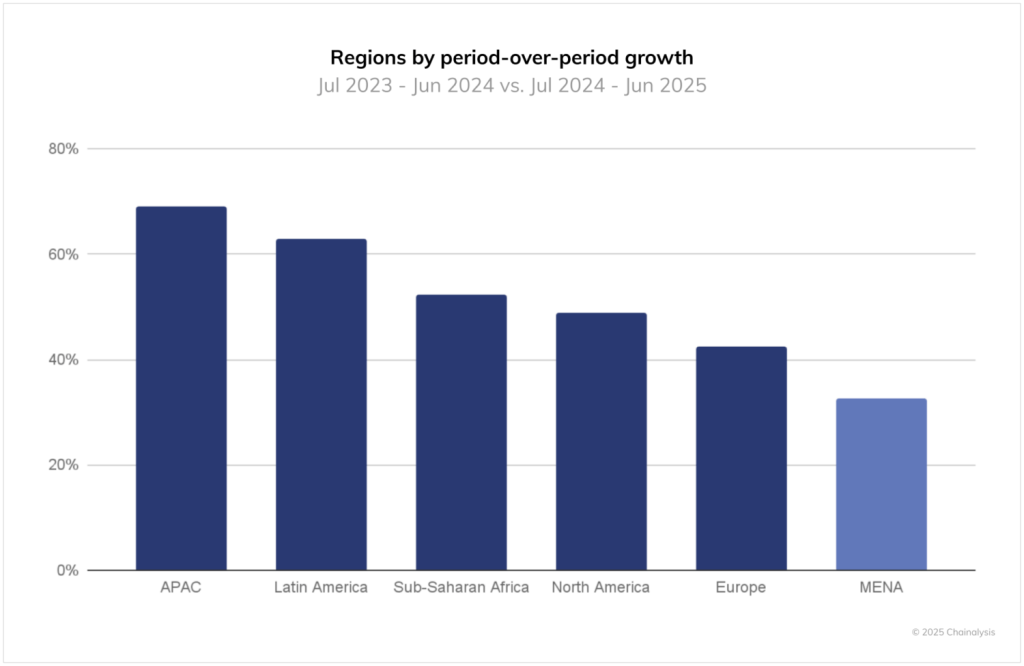

While the region’s year-on-year growth of 33% lags behind emerging markets such as Asia Pacific (69%) and Latin America (63%), the report points to a clear trend: cryptocurrencies continue to thrive in the MENA region despite economic instability and political uncertainty.

The case of Turkey stands out. Since the beginning of 2021, the country has seen a gross inflow of cryptocurrencies that will exceed $878 billion by mid-2025, even as it struggles with steep currency devaluation and persistent double-digit inflation.

Chainalysis notes that cryptocurrencies have become a financial haven for many Turks seeking to preserve wealth or escape the financial instability caused by the devaluation of the lira.

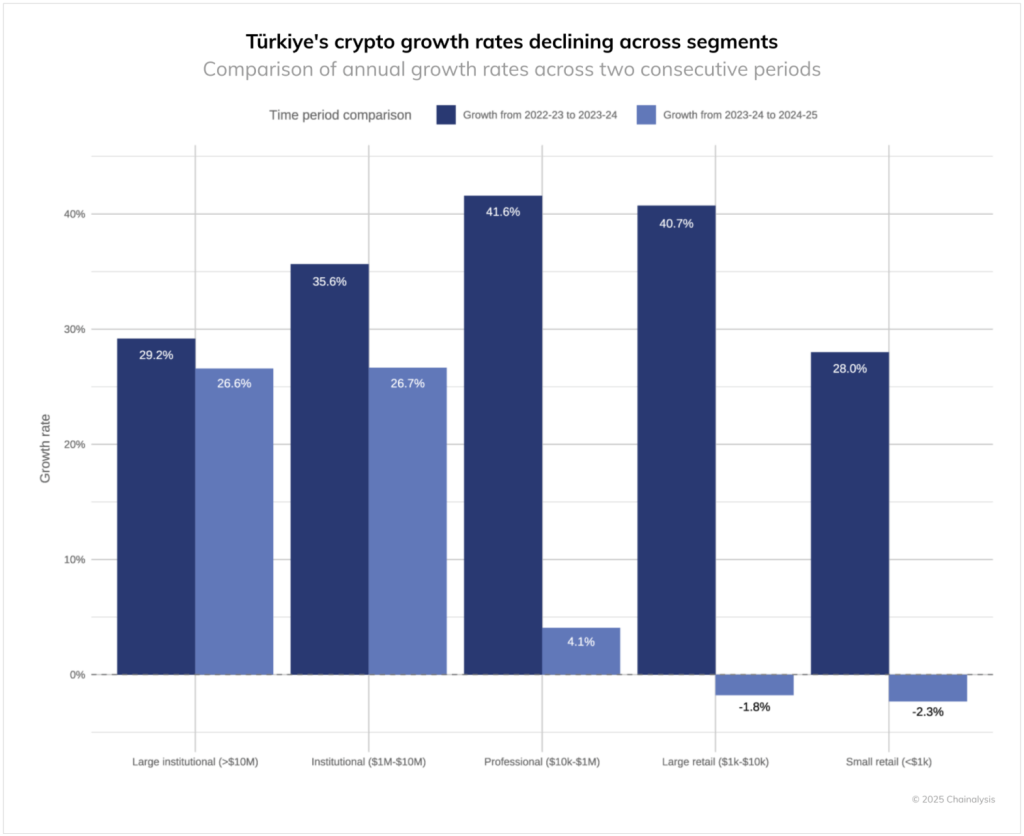

However, it also warns that the trading pattern suggests an increasingly speculative market, particularly as retail participation declines while institutional activity remains strong.

Despite the economic turmoil, Turkish crypto activity has maintained a consistent pace, suggesting that cryptocurrencies have become a key outlet for both wealth preservation and speculative trading.

However, the report notes a shift in participation patterns. Retail activity slowed sharply, with small and large retail transactions down 1.6% and 2.3%, respectively.

Professional traders also saw year-over-year growth drop from over 40% to just 4%. In contrast, institutional trading has proven more resilient as larger players look to hedge against inflation and exposure to digital assets.

Chainalysis attributes the shift to affordability issues, tighter regulations and waning confidence among smaller investors following sustained volatility.

Analysts attribute the drop in retail participation to affordability issues and tighter regulations imposed by Turkish authorities.

Turkey tightened its cryptocurrency regulations in 2024 and 2025 to comply with global anti-money laundering (AML) and FATF standards, a move analysts say has contributed to a drop in retail participation.

A new framework introduced stricter KYC rules, withdrawal limits and reporting requirements for crypto platforms. Transactions over 15,000 Turkish Lira (around $360 USD) must include identifying information and a 20-character transaction note.

Withdrawals without full sender and recipient information face delays of up to 48 hours, while new users face a 72-hour hold.

Organs also limited stablecoin transfers to $3,000 per day and $50,000 per monthwith higher limits only for providers fully complying with the travel rule.

Finance and Finance Minister Mehmet Şimşek warned that non-compliant companies could face fines, license revocation or a total ban.

Council for the Investigation of Financial Crimes (MASAK) gained new powers to freeze accounts associated with suspicious activity.

In March 2025 in Turkey further expanded its supervision by amending Act No. 6362 on capital marketsbringing all crypto exchanges, custodians and wallet providers under the Capital Markets Board (CMB).

The two communiques, III-35/B.1 and III-35/B.2, require platforms to operate as joint-stock companies, maintain minimum capital reserves of $4.1 million for exchanges and $13.7 million for depositories, and undergo proof-of-reserve audits.

The reforms also set governance and transparency standards, prohibited conflicts of interest, and mandated user protection mechanisms such as dispute resolution systems, clear risk disclosures, and segregation of customer funds.

Another reason that can lead to a decline in retail activities is the departure of major players from the nation.

For example, the crypto exchange Coinbase already has withdrew his provisional application enter the Turkish crypto market.

Rival exchange Binance as well he announced it would end its retail referral program in Turkey to comply with local regulations.

Despite the tighter regulatory environment, Turkey remains one of the most active crypto markets in the world, ranked 14th in the Chainalysis 2025 Global Cryptocurrency Adoption Index.

The government also floated the idea of a small transaction a tax of 0.03% to increase public revenuealthough Finance Minister Şimşek stated that profits from crypto assets are not yet subject to taxation.

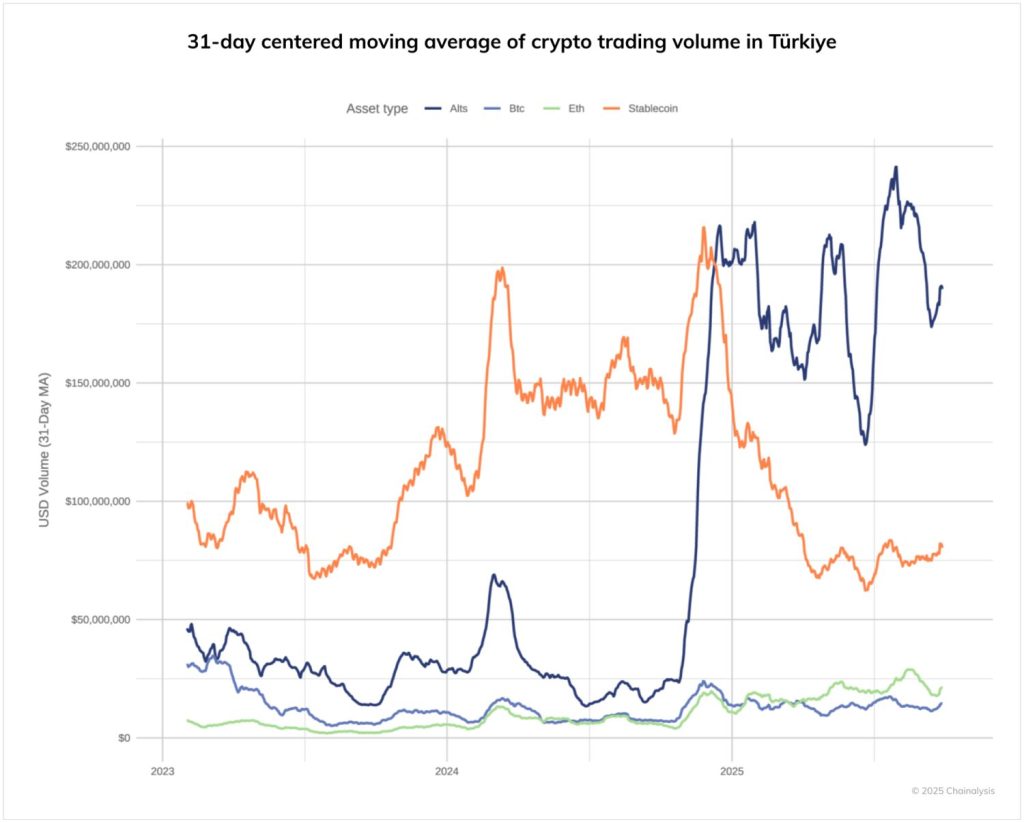

Meanwhile, Chainalysis’ analysis of trading behavior suggests that much of Turkey’s market activity has shifted towards speculative altcoin trading.

Data from CCData shows that altcoin volumes have grown from roughly $50 million at the end of 2024 to more than $240 million by mid-2025, overtaking stablecoins as the most traded asset class.

Analysts see this as a sign of increased risk-taking by investors seeking higher returns amid economic woes and tightening regulation.

Across the region, other MENA markets show contrasting patterns.

The UAE’s crypto sector has been steadily growing within a regulated framework, while Israel’s volumes surged after the October 2023 attacks as citizens turned to crypto as a financial haven.

Iran, meanwhile, has maintained steady growth despite sanctions and operates within a self-contained ecosystem that is largely cut off from global exchanges.