Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

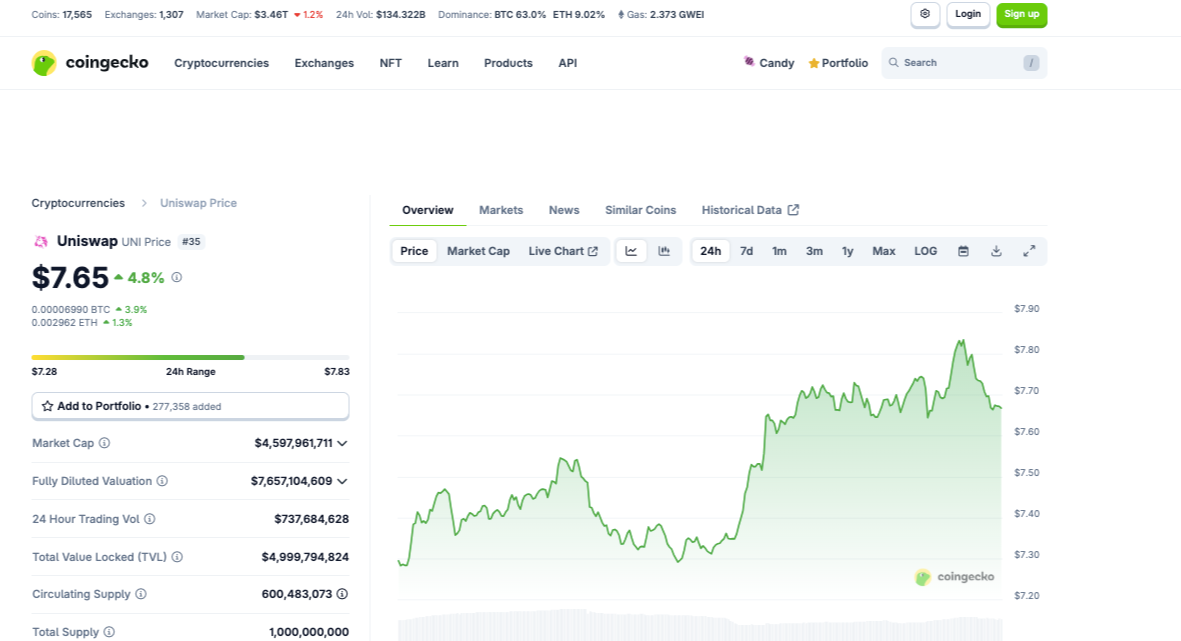

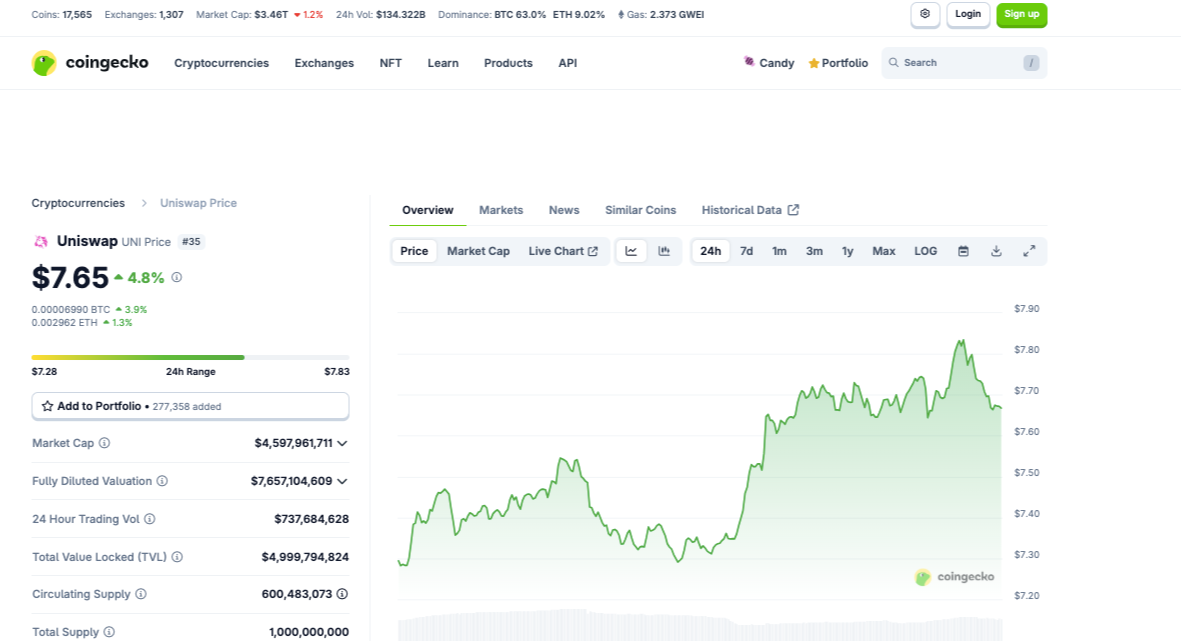

Uniswap ($ UNI) climbed 15% this week and pushed around $ 7.73 when traders resumed their focus on Defi leaders. A stable increase is a clear recovery of a 6.26 $ 6 June, supported by a consistent daily volume of trading with more than $ 350 million.

The ascending step coincides with the strong adoption of Uniswap V4, which can handle billions in stores after launch, and the improvement of regulatory clarity attracts greater institutional attention to the ecosystem of the protocol.

Uniswap remains one of the most convincing defi protocols to be monitored and bought, thanks to the tireless pace of innovation and the growing institutional interest.

Institutional investors also flock into the protocol. January 2025 Starting Uniswap V4 indicated a turnover point. This upgrade completely reworked architecture by consolidating liquidity funds into a single PoolManager contract and adding support for ERC-6909.

The ERC-6909 token standard supports both fungal and unusable tokens that offer flexibility. Interestingly, “hooks” now allow developers to put their own logic into the pools, unlock new layers of automation, risk control and intelligent defi direction.

The impact was immediate. According to Blockchain’s researcher, Sean Kennedy has already exceeded $ 1 billion in total locked (TVL) and processed more than $ 86 billion within six months, indicating rapid acceptance.

In addition to the V4, Uniswap, it also generates substantial revenues on the chain. As of the middle of 2025, it consistently ranks among the highest fees, with an average of 7 -day average of approximately $ 2.3 million in daily fees, fees according to to cryptof.

It remains the largest dex cumulative volume and overcomes $ 3 trillion in all times across Ethereum networks and layers 2, including ArbitratorOptimism and base.

Meanwhile, in the main shift of the US SEC policy, she said At the beginning of 2025 that some decentralized protocols could be exempt from the registration of securitiesIt offers a control space for Uniswap and potentially causes the “Defi Summer 2.0”.

For investors, Uniswap is more than just Dex. It is the backbone of the infrastructure for decentralized finances. Thanks to its technical superiority, expanding reach across the chains and the beneficial regulatory development makes it one of the most promising assets in the current crypto cycle.

The 1 hour chart $ UNI/USDT represents a classic V -shaped recovery after a significant sale, now after its vertical rally, it shows signs of short -term bull exhaustion.

From late June to early July, Uniswap consolidated between $ 7.00 and $ 7.30 than 1 July.

The following reflection was explosive because the asset jumped 24% to $ 7.74 in less than 48 hours, which created an almost perfect reversal of DO-DNO. This suggests a strong bull momentum, probably driven by short covers and opportunistic purchases at a surchanted level.

However, the sustainability of the recovery is now questioned. The price of the current session ($ 7.684) is located just below the high rally ($ 7.745), accompanied by a declining volume – a sign of fading.

MacD (12,26) tells a similar story. While the Bull crossover initially supported the rally, the MacD line (0.108) has now immersed under the signal line (0.148), and the histogram (+0.140) loses momentum up.

The convergence of weak volume, bear divergence MacD and refusal near $ 7.75 indicates profitable or fatigue of the buyer.

Fixed closures above $ 7.8 with increasing volume could invalidate the bull exhaustion, while the failure of a $ 7.6 could open $ UNI to a more significant pull towards $ 7.4, where buyers can enter.

While the structure of the V-Bottom remains technically bulls, the confluence of the weak volume, the MacD’s bear crossover and the rejection at the heights. Traders should wait for confirmation at the above key levels or prepare to support higher support.

Contribution Uniswap Assembly 24% of 48-hour V-Branks-Mohou Bulls to resist an upcoming test of $ 7.60? He appeared for the first time Cryptonews.