Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Blockchain technology should support the next global finance era, transforming everything from shares to interbancar settlement. Although fundamental technology is ready to support the acceptance of mainstream, the current user experience can be improved. The lack of safe power tools for infrastructure left users vulnerable and created an obstacle to adoption.

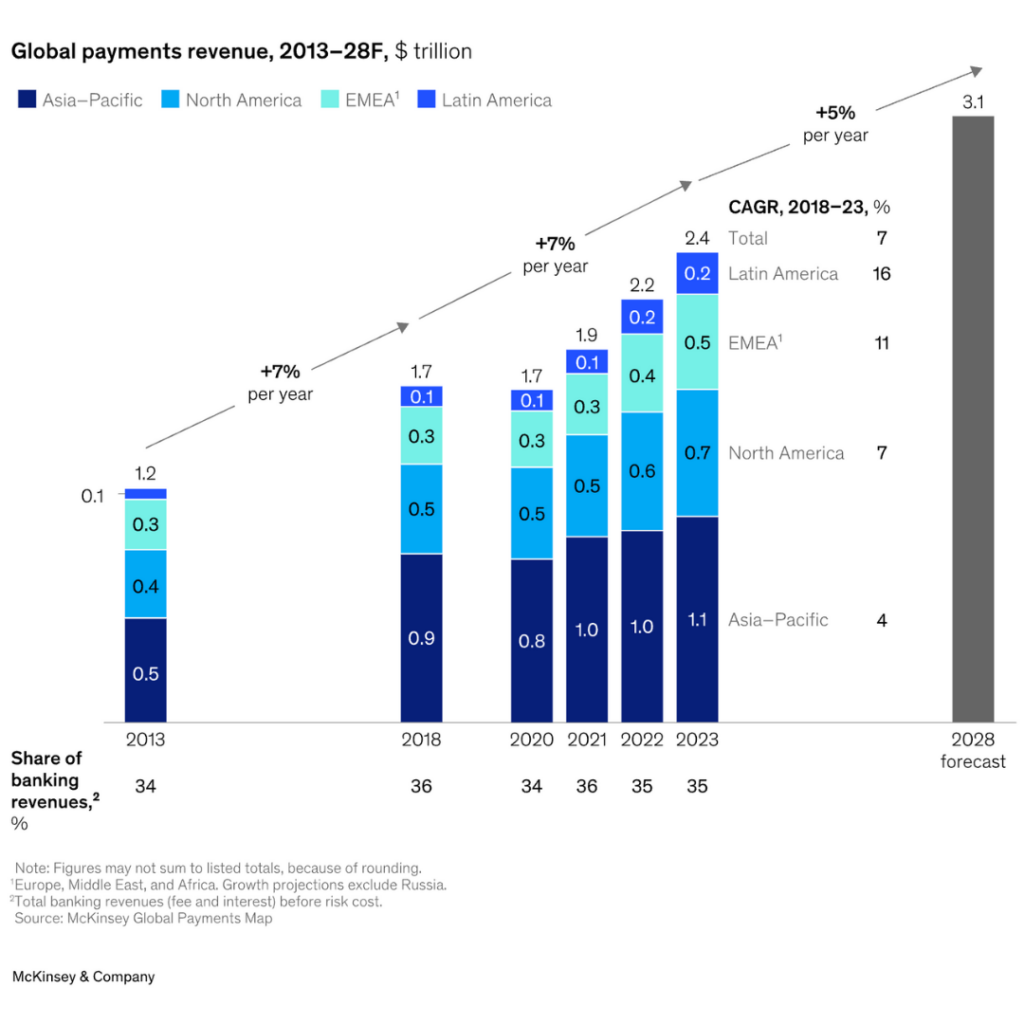

Very safe tools are needed, which are based on reliable infrastructure. Payments are a critical first step towards the wider acceptance of the Blockchain economy, as payments provide the entry point of Economics onchain and support the use of additional use cases. According to McKinsey & Company, Global Payment Revenue will exceed 3 trillion dollars until 2028.

In this post we explore the opportunity for digital payment and how Chain and MasterCardPartnership provides over 3 billion owners of a safe approach to the Blockchain economy.Billion Card Owner Inappropriate Access to Blockchain Economics.

Blockchain technology transforming global payment network. From the return water supply of the world’s largest banks to daily consumer transactions, Blockchain Tech allows for faster, safer and more cost -effective transactions. This is one of the most significant opportunities in finances, and it is envisaged that revenues from global digital payments will exceed $ 3.1 trillion until 2028..

Blockchain technology transforms different cases of payment use:

Main institutions Recognize the opportunity to achieve significant cost savings, unlock faster transaction time and access to new markets using blockchain technology.

In order to record this opportunity of three trillion dollars, institutions have to lower obstacles to entering, which makes the sure experience for users to enter the Economy onchain and adopt canvas systems based on blockchain.

While the global property of cryptocurrencies now exceeds 560 million people Since 2024, the vast majority of the world still do not communicate with the Blockchain economy. Even among current cryptocurrency users, engagement is often limited to trading and speculation, not to use blockchain for payments or other cases of use in the real world.

One of the main problems of refraining is to adopt Web3 The front and other tools needed to use blockchain -based systems do not satisfy the high levels of security that they accept from everyday users. In addition, there has been limited integration with existing financial systems that people are better known with. By integrating with reliable platforms that improve user experience, paying blockchain and the wider economy of Blockchain can help accept billions around the world.

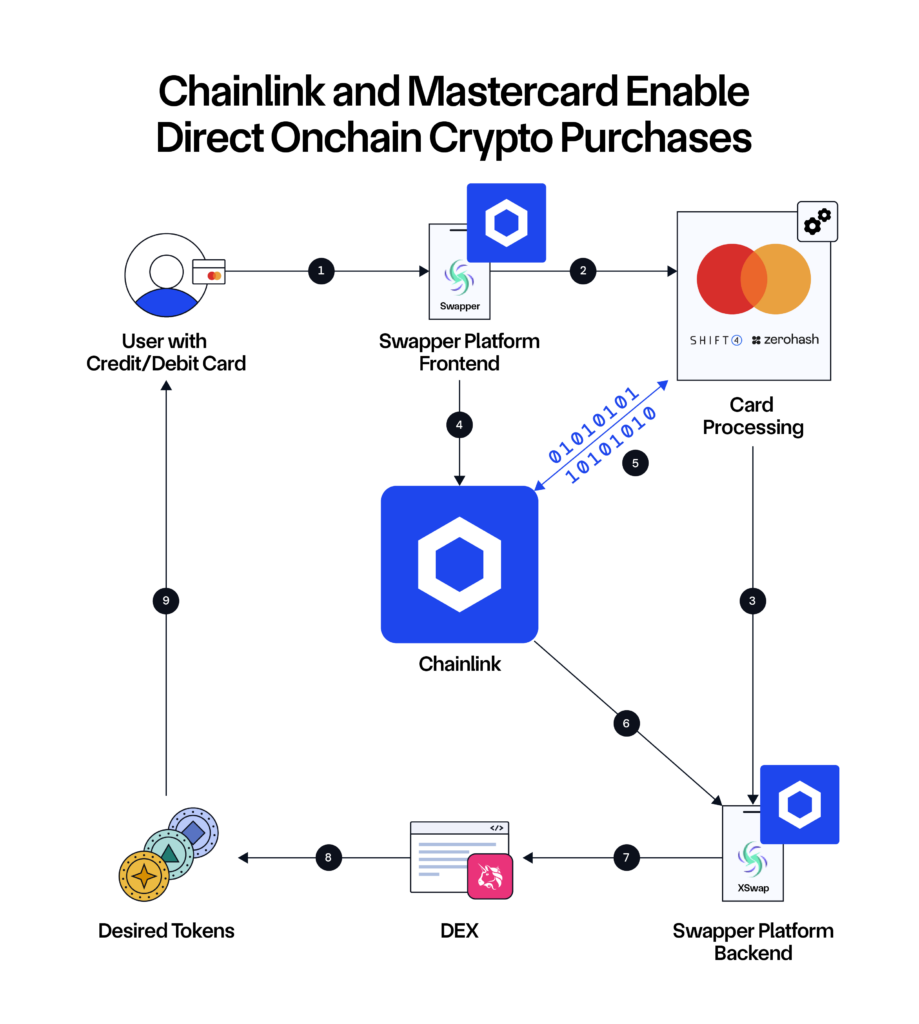

Chainlink and MasterCard connect the offshoin payments directly to the Ondchain Defin world. This breakthrough is launched by the chain of safe interoperability infrastructure and MasterCard’s reliable global payment network, removing the longtime obstacles that prevented mainstream users to access the Economy onchain.

“There is no doubt about this – people want to easily connect with the ecosystem of digital property and vice versa. Because of this, we continue to use our proven expertise and global payment network to bridge the jaz gap between the Onchain store. We include with antithetic on a chain, amorals and an innovative path to the revolution to revolution Dhamodharan, Blockchain Digital Property on MasterCard

Replacement finances Uses XSWAP, leading Dex built from a chain ecosystem that uses a standard of chain standard for data and interoperability, integration between Zerohash -Ai Shift4 payments. zero Allows the basic infrastructure for compliance, custody and transaction, allowing the conversion of FIAT cryptocurrency to smart consumption of the contract in a regulated manner.

“We are excited that we are an infrastructure partner, together with Chainlink and Mastercard on the SWAPPER Financing Platform. Zerohash flexible crypts and stable infrastructure infrastructure are dishonest, in accordance with KRIPTO-CRIPTO replacements. approaches to brobodalizing on brobarding transaction.

By bridging the gap between traditional and decentralized finances, the application makes it that payments based on blockchain are felt as an extension of the system users who already know, not as an unknown or unproven alternative.

Ultimately, this solution helps Blockchain industry to overcome the challenges of user adoption and realize the opportunity to pay in the amount of $ 3 trillion. Furthermore, the solution will improve onchain liquidity and initiate further growth.

Payments are just the tip of the iceberg. Blockchain Technology is set for the transformation of the entire financial system, from stock trading to Automated corporate actions. Payments are a critical first step towards a wider acceptance of blockchain -based solutions and can enter billions of users into the ecosystem.