Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

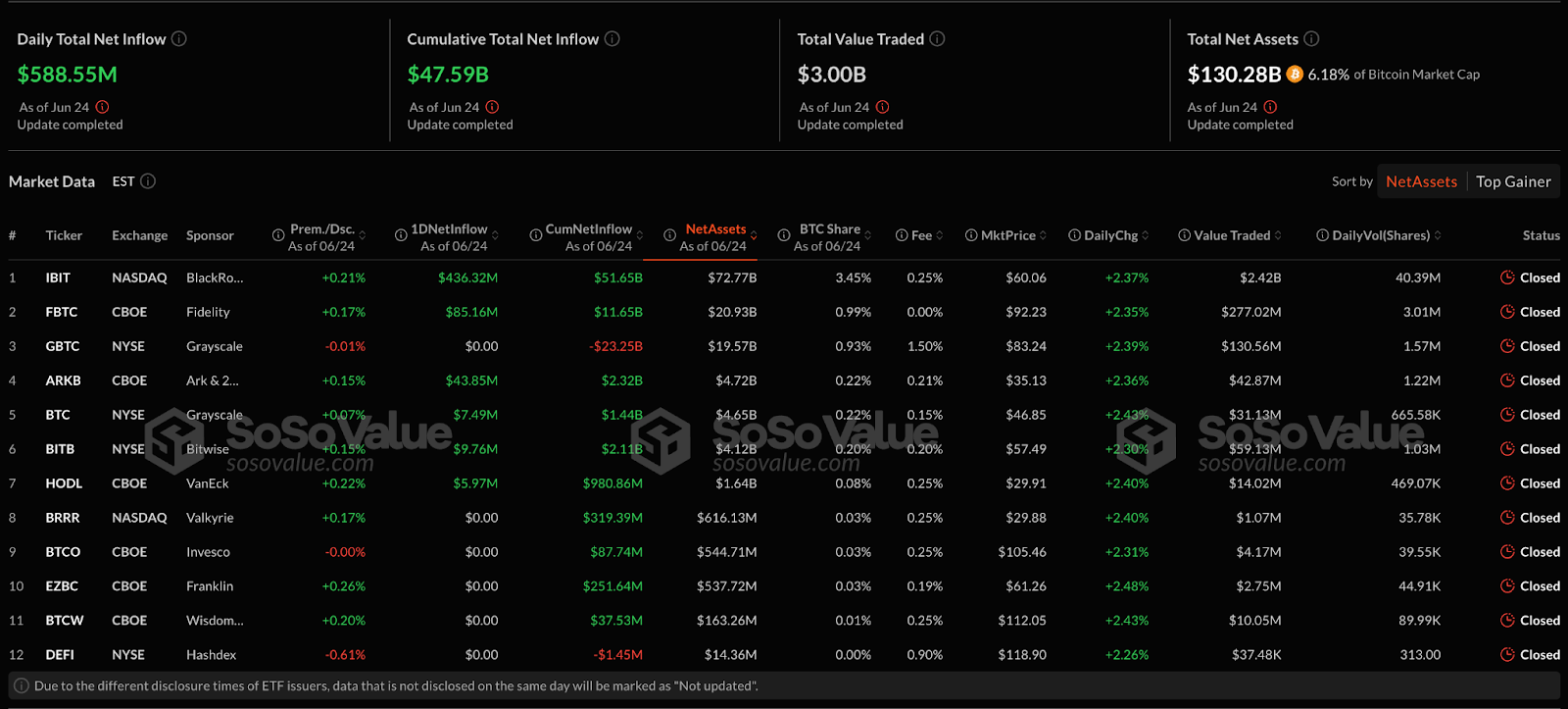

Funds traded on Bitcoin exchange (ETFS) resisted the growing geopolitical tension and uncertainty of the federal reserve by recording their eleventh consecutive day of positive tide and attraction 588.55 million USD in fresh capital since June 24th according to The data sought.

IBit Blackrock dominated the session with an influx of $ 436.32 million, which shows institutional confidence in Bitcoin Despite cryptocurrency trading around $ 107,000 after recent volatility. At the beginning of this year, he briefly touched $ 111,917 before retreating in the middle of tension in the Middle East.

Permanent momentum ETF comes when Bitcoin maintains its key psychological support over $ 100,000, which is the level it has defended since the beginning of May.

Institutional players, such as strategy, continue with aggressive strategies of accumulation. June 16, The strategy bought 10,100 other coins for $ 1.05 billionIt will bring its total share of nearly 600,000 bitcoins.

The eleven -day stripe represents the ninth consecutive week of positive flows for digital assets and contributes year -on -year a total of $ 13.2 billion Despite the wider market concerns about the conflict of Israel-Iran.

While Bitcoin was originally sold next to global shares when Israel launched late night air strikes against Iran“Since Tehran responded in a natural, recovery of digital assets over $ 100,000, associated with the permanent ETF demand, indicates that institutions are increasingly treating bitcoins as a portfolio diversifier than at risk speculation.

Recently Headler’s Head of Risk, Sergei Gorev note that while Gold originally captured the flows of safe, Bitcoin’s recovery suggests that the markets “firmly believe in the active development of the Iranian-Israel conflict phase”, and the declining power of the dollar benefits both rare metals and cryptocurrencies.

Institutional resistance becomes even more pronounced due to the aggressive campaign of President Trump against the chairman of the federal reserve Jerome Powell. Marked him “dull” and demanded an immediate reduction in rates This could save the United States $ 300 billion a year.

However, the continuous ETF inflow suggests that institutions are located for potential money release and at the same time ensure the currency. Recent data on the producer’s price index strengthens the arguments to reduce rates at the end of this year.

The acceptance of companies is still accelerating despite macro uncertainties. BTC Anthony Pompliano won 3,724 bitcoins For $ 386 million in the SPAC merger plans to publish SPAC while Japan The Metaplanet won $ 517.8 million on the first day of its ambitious “555 million plan”. which focuses on 210,000 bitcoins by 2027.

This development, combined with The Norwegian Green Mineral Plan to Purchase Bitcoins $ 1.2 Billion and Trump Media is a Strategy of the Ministry of Finance of $ 2.3 billionTo prove that institutional beliefs exceed short -term volatility.

The current technical structure of Bitcoins reveals a convincing setting that perfectly cope with the permanent inflow mobility ETF, with multiple time frames indicating the immediate escape towards the new maximum cycle.

The 3 -hour graph shows bitcoins trapped in a descending wedge pattern, with a critical resistance of the “The Edge” of around $ 109,000, which coincides with the recent maximums of almost $ 111,917. At the same time, the support of around $ 99,000 was successfully prevented several times.

Exponential moving averages show 15-term EMA for $ 105,459 located above 60 EMA periods per $ 104,425, indicating short-term construction of momentum up despite wider consolidation.

In particular, the monthly chart, as shown in the analyst Merlijntthetrader, provides an extraordinary insight into the cyclic behavior of bitcoins. It reveals a consistent formula of three -year bull runs, followed by one -year repairs, which were repeated with remarkable accuracy.

Currently, in its three -year expansion phase, which began in 2022 and is screened by 2025, Bitcoin seems to be located for significant potential. The momentum indicators are approaching, but they are not yet reaching the extreme levels of recess that have historically identified the peaks of the cycle.

This cyclic analysis suggests that any short-term weakness represents consolidation in broader progress, with the final targets potentially reach $ 150,000-200,000 based on a historical precedent.

Comparative analysis of Bitcoin cycles 2020 and 2025 reveals significant similarities in prices and momentum properties. Both cycles showed comparable patterns of consolidation before the experience of great progress.

MACD indicators show that both cycles are experiencing deep negative divergence during the consolidation phases before creating a strong bull momentum. The 2025 cycle appeared at a similar inflex point that preceded the parabolic procedure of 2020 to $ 42,000.

The four -hour chart identifies the successful filling of the space and the gap testing of a real value of around $ 102,500-103,000, with a “non -unmired real space” in the upper resistance zone.

A break over $ 107,000-108,000 could trigger algorithmic purchases at the previous maximum near $ 111,917, which perfectly places bitcoin to earn an institutional tide, regulatory clarity from Japanese proposed crypto tax reformand continued Adoption of the corporate cash register.

Contribution US bitcoin ETFs hit an 11-day tributary strip with $ 588 million led by blackcock despite macro concerns-is $ 107,000 to push 112k ATH? He appeared for the first time Cryptonews.