Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Unlike yesterday’s picture, the Krypto market is down today, with almost all 100 best coins on the market ceiling to see their prices falling over the last 24 hours. At the same time, the market capitalization of the cryptocurrency dropped by 4.2% to $ 3.43 trillion. The total volume of trading is $ 97.3 billion, especially compared to yesterday’s $ 120 billion.

TLDR:

At the time of writing, only one of the 10 best coins on the market cap is green.

Bitcoin (BTC) It is 0.4%, which means it is usually unchanged and is currently traded for $ 108,836.

Ethereum (ETH) He saw a drop of 2.1%, currently changing his hands to $ 2,547.

DOGECOIN (DOGE) He saw the highest decline in this category: 4.4% of the price of $ 0.1673.

At the same time, TRON (TRX) It is the only green coin, but with an increase of 0.4%, which means that in the last day it has practically not changed to $ 0.2856.

In addition, five out of the 100 best coins were seen, but only one of them was high enough to move the price. PUDGY PENGUINS (PENGU) is 1.8% to $ 0.01576.

On the other hand, PEPE (pepper) saw the highest decline of 8.3% to $ 0.000009791.

PUDGY PUDGY PENGUINS TEAM Recently summarized their achievements over the past few months, including partnership with Nascarlive on Upbit and Revolut, Cboe Administration for the Canary PENGU ETF and more.

Meanwhile Define Corp. jumped 17% Thursday after the company revealed to have received $ 2.7 million Solan as part of his strategy of the cash register crypt. At the beginning of this week, she said she was planning to obtain $ 112.5 million through private locations, and she is expected to close on Monday.

Sean Dawson, Research Head on the decentralized onchain Options platform platform, Derive.XYZHe noted that “the greatest fluctuations in the June prices were geopolitical”. During the key escalating points in the Middle East, we saw the main drawing of 13 and 22 June.

This means, “The spikes of limited volatility tell us that the markets have been betting on a limited fall. This is exactly what was played,” says Dawson. “The mute reaction in monthly volatility suggests that traders were correctly expected to contain hostility.”

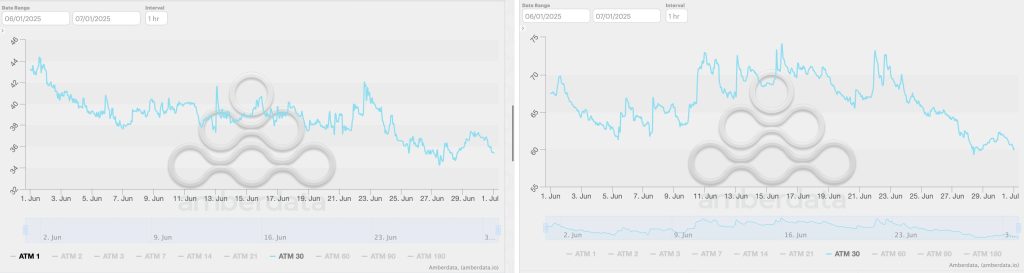

In addition, volatility treated BTC and BTC below. The 30 -day volatility of the former previously dropped from 44% to 36% and the second from 68% to 60%.

BTC and ETH 30 -day volatility

Dawson continues: “The traders put on Great July, with volatility suppression and placement, all eyes are now on Fed, macro data and other geopolitical development. ETH has a stronger narrative, but the BTC option market is curled up for decisive step.”

Between catalysts up for BTC they hit $ 130,000 US federal reserve system Reducing rates at the meeting of July 29 (25% chance) and De-Estriate in the Israeli War against Iran and Palestine.

Catalysts that could lead to a price of prices to $ 90,000 include the tone with Hawkish Fed, hot inflationary printing, increased tension in the Middle East, ETF drain and the capitulation of the miner.

Finally, on Dawson, there is a 10% chance that BTC will exceed $ 130,000 by the end of August and 15% of ETH’s chance will exceed $ 3,300 in the same period.

ETH sentiment is significantly bulls than BTC, he says. “ROBINHOOD’S Notification L2 on Arbitrator For tokenized shares in the EU, they could re -enter the story of the real world (RWA) around Ethereum. ”

At the time of writing, BTC is traded for $ 108,836. This has seen quite jerky trading in the last day. The price dropped twice to the level of 180 830 USD and its current price is its domestic low. This follows a decline from a daily maximum of $ 110,386.

At the same time, Ethereum is currently trading $ 2,547. As the graph shows, the coin continued to decline from a daily maximum of $ 2,630 to the lowest day point so far $ 2,532 before it increased slightly to the current price.

Meanwhile, the market sentiment remains mostly unchanged in the neutral territory. The fear and greed index increased yesterday from 55 to 55 today. Investors are still waiting for further news and signals that would cause further increase in greed or drops to fear.

Especially on July 3, BTC BTC Funds recorded an incredible influx for the exchange of trade (ETF) 601.94 million USD. This means the highest positive daily flow in six weeks, from May 22. From the total amount, Fidelity represents $ 237.13 million, Black -shin 224.04 million USD and Ark & 21 shares $ 114.25 million.

Also July 3 $ 148.57 millionSignificantly higher than the drain of 2 July of $ 1.82 million. Black -shin and Fidelity He saw the highest positive flows of $ 85.38 million and $ 64.65 million.

Meanwhile in Singapore based in Singapore Amber International Completed a private placement of $ 25.5 million For its reserve fund crypto ecosystem of $ 100 million. The company acquainted by NASDAQ announced its Krypto reserve strategy at the beginning of this year diversifying allocation in Bitcoin, Ethereumand Solan. Now expands to Binance coin, XRPand Sui.

The Krypto market has fallen over the last 24 hours, while the US stock market has seen another day of mixed power on Wednesday. For example S&P 500 increased by 0.83%, Nasdaq-100 increased by 0.99%and Dow Jones industrial average increased by 0.77%.

Ruslan Lienkha, Chief of Markets YouhodlerThey say Bitcoin “is ready to watch shares on a new maximum”. This week there was an increase in optimism on the American capital markets, with the S&P 500 hit the new ATH. “If the S&P 500 adheres to its previous peak after the release of wages without a farm in the coming weeks, it could serve as a strong technical and psychological catalyst not only for stocks but also for the cryptocurrency market.”

It seems that this is another short -term immersion on the market, which means that a minor decline is before further push higher. In the medium term, analysts expect prices to increase overall, regardless of inevitable decreases.

Contribution Why is Krypto down today? – 4 July 2025 He appeared for the first time Cryptonews.