Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

After a significant increase today, the crypto market is today. Most of the 100 best coins have dropped in the last 24 hours. In addition, the market capitalization of cryptocurrency in this period dropped by 1.6% to $ 3.4 trillion. The total volume of trading crypto is $ 99.8 billion.

TLDR:

Six out of the top 10 coins per market cap is higher, but with a low increase of less than 1% per coin.

Bitcoin (BTC) Award by 0.7%, now traded for $ 106,413. This is from $ 101,924 seen two days ago.

Moreover Ethereum (ETH) Award by 0.8%, changing hands to $ 2,443. It’s one of the best artists of the category today. Lido bet ether (Steth) and TRON (TRX) It also recorded a 0.8% increase.

XRP (XRP) It recorded the highest decline in this category by 0.7% to the price of $ 2.18.

In addition, most of the 100 best coins have dropped their prices in the last day. The highest decline between them is Virtuals Protocol (Virtual) ‘ 8.5% to 1.56 $.

On the other hand, Pi Network (PI) He appreciated the most today: 13.4% to $ 0.5998. This is the only double -digit change in this category. Aptos (aptos) This is followed with a 9% increase to $ 4.83.

In particular, the market after several positive news was cold yesterday.

Prices yesterday recorded a rapid increase Japanese Agency for Financial Services proposed Reclassify digital assets According to the Act on Financial Inspections and Exchange, which could reduce crypto taxes from 55% to 20% and increase the chances of Spot ETF.

In addition, recent macroeconomic changes and lower geopolitical risks, namely the announced ceasefire between Israel and Iran, increased the crypto market, while investors have turned their attention to risky assets.

It seems that the fragile agreement has been holding for the time being, although information from Israel, the US and Iran is not entirely clear. At the same time, Israel continued Genocide in Gaza.

Development in the region can quickly move and affect the markets across the board equally quickly.

Harz’s house, co -founder of layer 2 BeanHe said that the recent BTC price decline under $ 100,000 shows how geopolitical uncertainty triggers a sentiment with a risk. This means that DIP is not “a long -term problem and it is just a distraction from Bitcoin’s real trajectory,” says Harz.

“While some are fastened in short -term repairs, it is undeniable that bitcoins, and especially bitcoin defines, are eventually on the rise.”

It is certain that bitcoins are actively ripening and entering the phase defined by institutional acceptance, brighter regulation and rapid technological progress, he says. This is because Bitcoin’s usefulness, says Harz. Institutions do not just want to hold bitcoins, but also work.

In addition, Gadi Chait, an investment manager at XAPO BankHe argued that the status of Bitcoin’s Safe Havana was still formed. “However, the recent signals indicate that they are coming.”

“Traditionally perceived as volatile, a bitcoin response to recent shocks, such as events in the Middle East, was primarily limited, nor perfectly watched gold or reflected capital sales,” says Chait.

Geopolitical shocks often evoke an initial flight to cash, but Chait says that “a combination of institutional assemblies and macro-fired offers now means that the decreases are shallower and recover faster than in the previous cycles.”

“In a recent market decline, relatively shallow bitcoin strokes that have been paired with a consistent institutional influx, shift perception. Its growing gold correlation suggests that it is considered a task, while on the other hand it reflects its rapid bouches into the main financing.”

At the time of writing, BTC is traded for $ 106,413. During the last day, the price gradually increased from the daily minimum by $ 104,854 to Intraday a maximum of $ 106,691.

The coin exceeded the level of $ 106,000. Investors are now waiting to see if it breaks at $ 107,500, or maybe falling below $ 104,000. These movements would open the door to further increase the price or drop.

At the same time, Ethereum is currently traded for $ 2,443. He jumped to Intraday a maximum of $ 2,473 before decreased to $ 2,428 overnight (UTC).

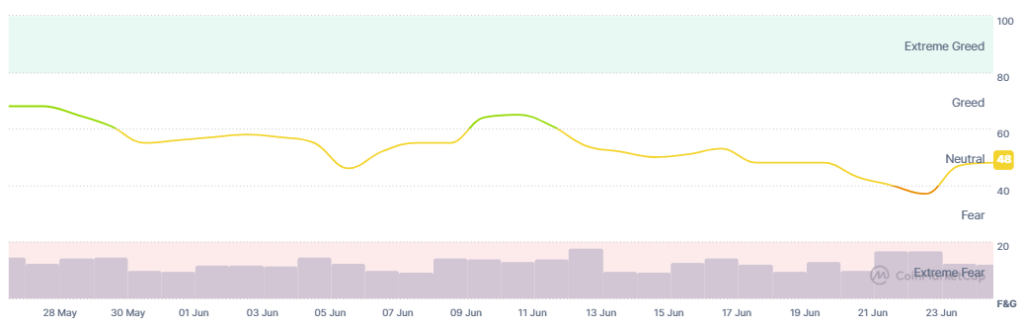

Meanwhile, the sentiment of the crypto market remained in a neutral territory after leaving the feared zone yesterday. The fear and greed index increased from 47 yesterday 48 today. The graph below shows a sentiment that has gradually decreased over the last 30 days.

The present value indicates some restlessness and caution in the market, even if investors do not panic.

In addition, June 24, when the market saw a significant increase, recorded American funds traded on the BTC (ETF) Stock Exchange (ETF) remarkable 588.55 $ A million in tide. Black -shin It is at the top of the list and records the tide of $ 436.32 million.

In addition, the US ETH ETF has noticed the tide 71.24 million USD. Blackrock took $ 97.98 million while Fidelity lost $ 26.74 million.

Meanwhile Japanese Investment Company Metaplage The first day of his plan “555 million 555 million” received more than $ 517 million. By the end of 2027, the company plans to get 210,000 bitcoins, which is about 1% of the total offer.

Also entrepreneur Anthony pompliano Procap btc announced that it has Obtained 3 724 BTC for $ 386 million. This comes only a few days after revealing the plans that will be published at the end of this year.

The Krypto market has seen a shift to reddish development since last night, while the stock market increases on Tuesday. The S&P 500 increased by 1.11%, Nasdaq-100 increased by 1.53%and Dow Jones industrial average increased by 1.19%. The stock market responded directly to an agreement on the ceasefire between Israel and Iran.

The market shows caution. So far, there is no panic that is talked about, and analysts are bull in the long run, but unstable global situation can be lower.

Contribution Why is Krypto down today? – June 25, 2025 He appeared for the first time Cryptonews.