Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The crypto market is down today. Most of the 100 best coins have seen price drop in the last 24 hours, but most top 10 coins are upstairs. In addition, the market capitalization of the cryptocurrency dropped by 1% in this period to $ 3.43 trillion. The total volume of trading crypto is $ 99.9 billion, to the same level as yesterday.

TLDR:

Five out of the top 10 coins on the market cap are up, while three are at the time of writing down (they do not take two stablecoins).

Bitcoin (BTC) He appreciated 1.5%, now traded for $ 107,827. Especially from $ 101,924 in six days.

Moreover Ethereum (ETH) He appreciated the most in this category. It’s 1.9%and changes their hands to $ 2,480. Lido bet ether (Steth) saw the same rise.

Binance coin (BNB) He recorded the smallest increase in this category 0.3%, which means it is unchanged, now costs $ 2.19.

In addition, about 20 out of the 100 best coins have seen their prices for the last day, many of which were related to ETH. Caspa (CO) and Bitcoin Cash (BCH) He appreciated the most: 5.2% of each price of $ 0.0781 and $ 496.

At the same time, two coins saw a double -digit reduction. Fartcoin (Fartcoin) is 11.3% to $ 0.9739, while Six (six) dropped by 11% to the price of $ 0.2755.

Especially, SofiThe financial platform based in San Francisco, plans Re -trading with BTC and ETH Later this year, after leaving the space in 2023. In addition, it will add additional functions, including crypto -lending, betting and stable support.

Harz dom, co -founder L2 BeanHe noted that geopolitical uncertainty led to a short BTC dip below $ 99,000, followed by recovery to consolidation over $ 105,000. This signals growing market maturity, Harz says.

The recovery shows growing liquidity and deeper integration of coins into the main portfolios, with both institutions and retail investors entering the space. The US Spot Bitcoin ETF has seen 12 consecutive days of positive flows – the longest lane since December 2024.

“Bitcoin is now sitting on institutional adoption, retail momentum, regulatory clarity and integration into the foundations of the global financial system,” says Harz.

“The next one is the last part of the puzzle: a technological jump forward to allow real bitcoin defi. This breakthrough is closer than ever. How the progressive infrastructure is catching up with capital tides, Bitcoin is ready to move to its public phase and place the basis for further financing and payment.”

Speaking of ETF, Andrejs Balans, Risk Manager YouhodlerHe notes that “the momentum of bitcoin ETFS could not be ignored,” billions of dollars flow.

“This tells us that institutions are no longer based on the sidelines. Bitcoins are treated as a long -term benefit, just like gold or government bonds. Thanks to the ETF, they can do it through familiar regulated channels. It is not flashy, but it is one of the strongest brands that Crypto has earned at the financial table,” Balans writes.

In addition, the total assets are also available to the maximum, with more sophisticated strategies based on BTC, ETH and diversified crypto baskets.

“It is a clear signal that this market is no longer just about chasing short -term profits. It is a long -term location, risk management and belief in the future of digital assets,” Balans says. “We are no longer in the first days, and we are not just for memes. With clear rules, growing confidence and institutional acceptance, crypto becomes part of the financial mainstream.”

He also discussed the role of the Ethereum and claimed that “it became quietly a layer of digital economy infrastructure”. It offers a return through betting that institutional investors are increasingly exploring. “The return on digital assets in a safe and convenient way is exactly the kind of offer that could bring traditional finances even deeper into the crypto,” Balans says.

At the time of writing, BTC is traded for $ 107,827. The chart shows that the price gradually rises from intraday minimum $ 106,170. Shortly, the daily maximum of $ 108,117 was hit before it was slightly remedied to the territory of $ 107,000.

This means that the BTC managed to break the next level that investors expected to see, a brand $ 107,500. He also began to repeat $ 108,100 and create trips for further climb. As a result, it also hit the weekly high high height and recovered from a minimum of $ 974. Other goals are $ 110 490 and $ 112,080.

At the same time, Ethereum is currently traded for $ 2,480. This morning (UTC) jumped to Intraday a maximum of $ 2,510. In addition, the coin is currently working to overcome its weekly high $ 2,552, but it is not yet completely. This means that the current price is a remarkable increase from an inner minimum of $ 2,177.

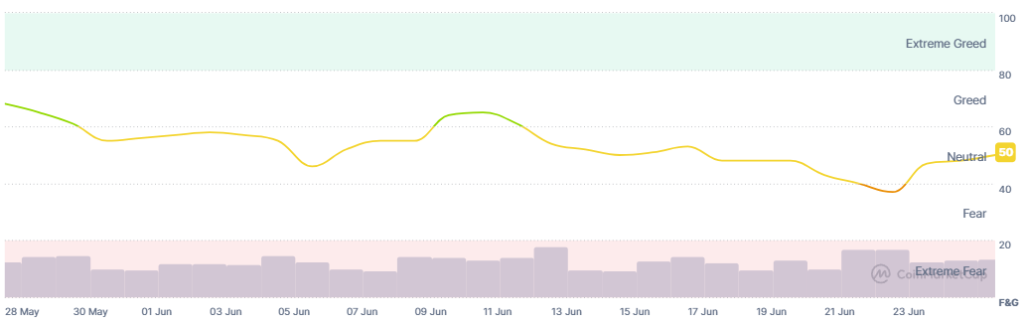

In addition, the crypto market sentiment moves along the neutral territory after the end of the zone two days ago. The fear and greed index has seen a slight increase in the last day of 48 yesterday to 50 today. These steps indicate caution on the market, but not panic among investors.

In addition, June 25, American funds traded on BTC (ETF) exchange have seen another significant tide day and saw 547.72 million USD. Black -shin is on top of the list and records the tide of $ 340.28 million, followed by Fidelity $ 115.19 million. The cumulative total net tide now reaches $ 48.14 billion.

In addition, the US ETH ETF has noticed the tide 60.41 million USD. From this amount Blackrock saw $ 55.18 million and Bitwise $ 5.23 million. Currently, the cumulative total net tide is $ 4.13 billion.

Especially Japanese society Metaplage has Added another 1 234 BTC In its cash register, thus its total shares increased to 12,345 BTC. It is part of his plan “555 million”, for which he aims to win $ 5.4 billion to buy 210,000 BTC by 2027.

Moreover Moscow Exchange is set to Run a new Futures Bitcoin Index FuturesIn addition to crypto funds and structured bonds. CEO Vladimir Krekoten said the new introduction of the BTC derivative instrument was “immediate”.

While the crypto market has seen another relatively small daily decline, the stock market saw a mixed picture on Tuesday. The S&P 500 dropped by 0.00033%, Nasdaq-100 increased by 0.21%and Dow Jones industrial average dropped by 0.25%. Analysts say the stock market responded to US President Donald Trump and was looking for a replacement for the chairman of the federal reserve Jerome Powell.

As analysts have previously predicted, the market will continue to see decreases, while prices have increased in the long term. This is likely to continue the foreseeable future.

Contribution Why is Krypto down today? – June 26, 2025 He appeared for the first time Cryptonews.