Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Krypto market today has seen another shift: although the market ceiling is down, most coins have noticed that their prices increase to point rally. The cryptocurrency market capitalization has fallen by 0.9% in the last 24 hours and now cost $ 3.45 trillion. The total volume of crypto trading is $ 131 billion at the time of writing.

TLDR:

While all the top 10 coins of recorded prices are decreasing at this time, it is now in red. And XRP dropped by 2.3% to the price of $ 2.42.

The best artists of the category are Ethereum (ETH) and TRON (TRX)which increased by 2.1%, traded to $ 2,602 and $ 0.2757. Especially this is the highest point ETH on the last day.

After reaching daily maximum $ 104 $ 273, Bitcoin (BTC) He retreated back to $ 103,928, but is still 1.9% per day.

Story (IP) It is the highest profit in the TOP 100 category, appreciated 12.8% to $ 4.97. At the same time, Quant (Qnt) Most fell: 3.9% on the price of $ 93.94.

The market has seen a significant increase in investors’ interest. According to the recent report Financial rivercompanies across different industries Added 157,000 BTCEquivalent $ 16 billion, this year their balance sheets. Michael Saylor’s Strategy (e.g-Microstrategy) represents more than 75% of it.

One of the latest that announced its strategy of Bitcoin’s accumulation is Chinese consumer company DDC Enterprise. It plans to immediately add 100 BTC to its balance sheet to accumulate 500 BTC within six months and 5,000 BTC within 36 months.

Ruslan Lienkha, Boss of Markets on Fintech Platform YouhodlerHe noted that the ascending momentum in the stock markets alleviated after the end of the tariffs. Short -term traders began to lock profits, which previously launched short -term repairs.

The pull -out was correction in a wider medium -term UPTRED. That has now turned up. “However, the ongoing global economic uncertainty and permanently high interest rates in the US may act as headwinds, which potentially limits the potential of this trend,” says Lenhka.

James Toledano, Chief Operating Director at Unity walletHe notes that BTC seems to be in accordance with the market expectations. Over the past week, it has maintained almost $ 104,000, suggesting a healthy consolidation phase. Recent decreases seem to be a structural problem, but normal volatility of the market.

“Anything over $ 100,000 is a victory when we are looking for stabilization and price support at this level,” Toledano says.

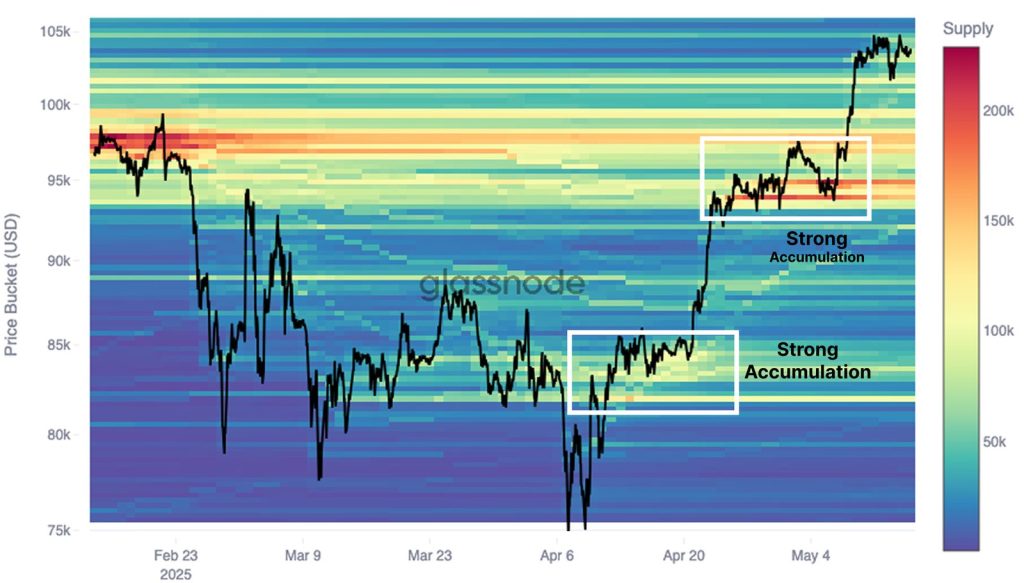

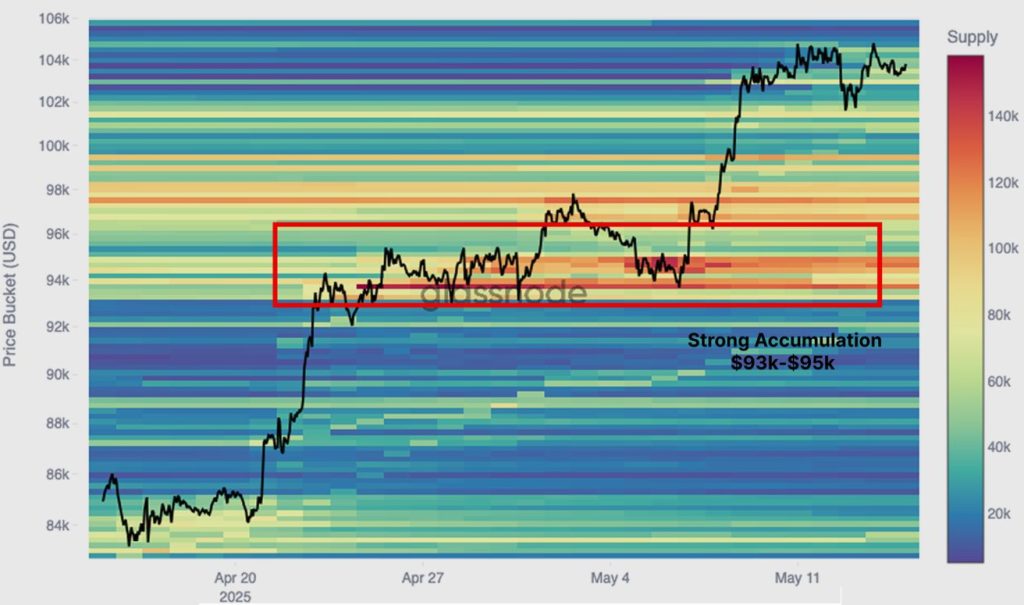

Moreover according to to the latest Glass node The report, from the low price of $ 75,000 in April, the Bitcoins markets experience the assembly, while between each movement is the phase of the parties.

It seems that Bitcoin’s assembly at $ 104,000 is controlled in combination with a strong accumulation on the chain and the flow of off-rings. Demand is primarily through the funds traded on exchange (ETF) and the main point exchange as Coinbase.

Toledano adds that the integration of Coinbase into the S&P 500 “confirms that crypto is no longer peripheral, nor has financial pariah looked down – it is a ripening sector with a systemic and growing meaning.” This development is expected to manage another influx of investors. However, the exchange is reportedly faces an investigation about sec over the accuracy of their reported user numbers.

In addition, the US consumer price index (CPI) Data from 13 May 2025, proposed to cool inflation, signaling that Federal reserve This could announce a reduction in the rate at the end of this year, the crypt stock exchange Cooperative he commented. However, he warned that the debt ceiling agreement in July or August could “again lead to the tightening of the system’s liquidity, which potentially exerts pressure down on risk assets”.

Bitcoin possibilities “The unimorative volatility of bitcoins decreased from 65% before the CPI release to 58%. This shows the expectations of short-term price stability. The ETH options show a longer bull structure for $ 4,000-5,000.”

While the macro trend supports the long -term bull, short -term graphs indicate caution. Although the BTC has managed to move above $ 103,400, so the bull turns, there is still potential to turn back and drop up to $ 100,700 or below a psychologically important level of $ 100,000.

According to Glassnode scientists, the key accumulation zone has appeared between $ 93,000 and $ 95,000. It is likely to act as a strong level of support if the short -term market occurred. It will be “a zone of demand where investors are likely to see value again.”

Moreover, the index of fear and greed has fallen from 71 years, which was now for 69 years. This suggests increased optimism, trust and shopping activities. However, this can lead to excessive trust and overvaluation.

Meanwhile, on Thursday, a net tide of $ 115 million recorded in the USA. Yet it’s a mixed picture. While Black -shin The Ark 21 Shares recorded $ 410 million at $ 132 million per drain.

According to Glassnode, “ETF flows show that institutional interest in bitcoins remains relatively robust, with a tide similar to the size of those that are in 2024.”

In particular, the weekly average net tide reached a peak to $ 389 million a day 25 April. This coincided with an increase in the purchase of powered spot and supported the rally to $ 104,000. Since then, the tide has fallen to about $ 58 million a day.

Meanwhile, HTX in the short term “high percentage of short -term profit holders and concentration of lever positions mean that any escape or schedule of key technical levels could trigger a concentrated cascade for profit and liquidation, leading to increased volatility. trend, which is a short -term condition. ”

Today, crypto market markets see ascending movement as a result of institutional interest, development of politics and investors’ sentiment. The first one seems to show more enthusiasm for investors. However, S&P 500 is 0.4%today, NASDAQ-100 has increased by 0.078%while Dow Jones The industrial average increased by 0.65%.

The continuing influx into the point Bitcoin ETF suggests long -term investor confidence, while long -term holders (LTH) still accumulate, there is also a bull signal. However, the greed is growing and BTC is approaching its historical high, where it is strong resistance. The rally may face the heads, if the greed further rises, the ETF tributary slowly and/or the macro conditions will move.

Contribution Why is Krypto today – May 16, 2025? He appeared for the first time Cryptonews.