- The XRP van suddenly dropped to more exchanges, with UPbit saw the largest download of about 5.5 billion XRP.

- The activity was warmed up, indicating the potential for the XRP ETF supported by Vaneck MVDApp..

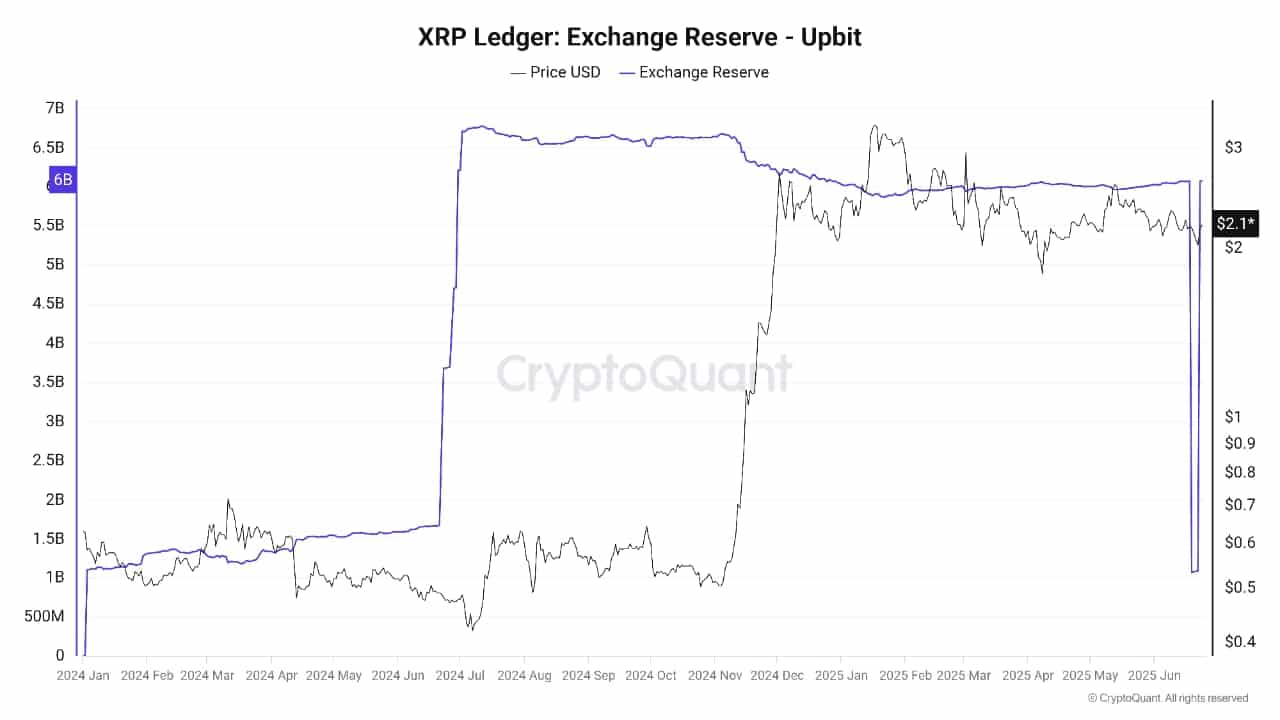

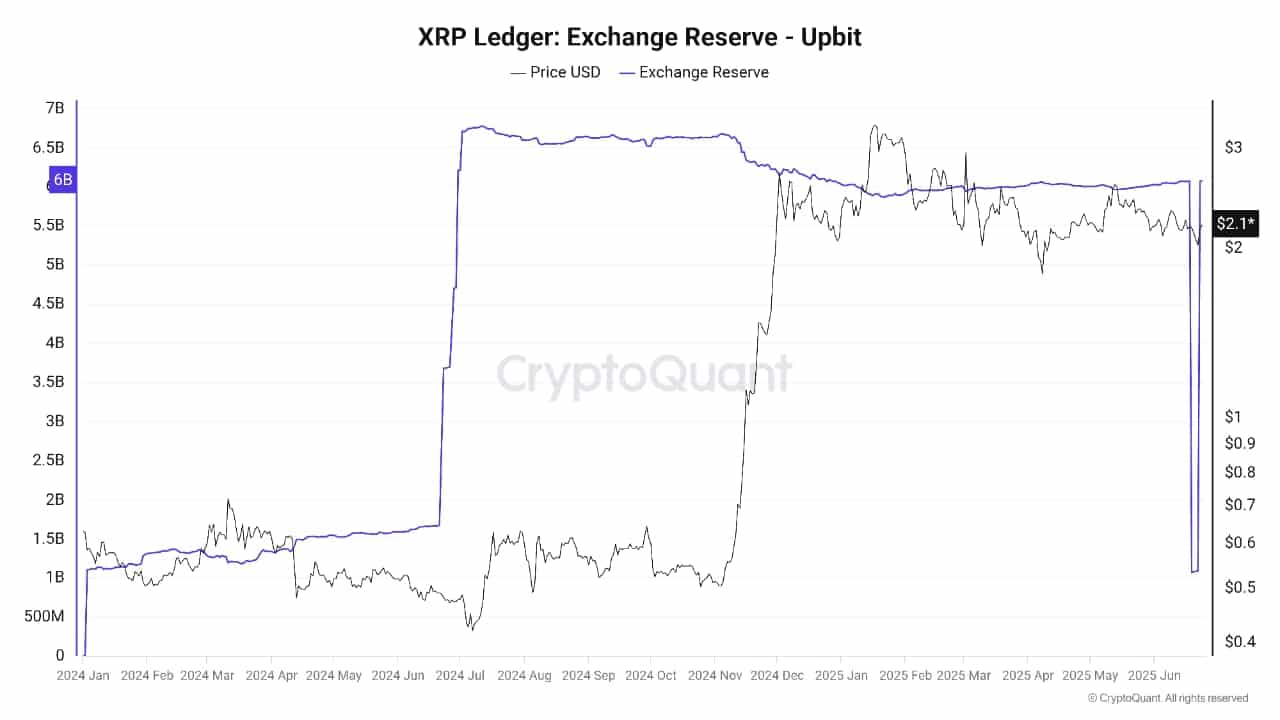

Reserves Wave [XRP] noted significant decreases on the main exchanges, per Kryptoquant Data. UPbit saw the highest level of decline when it fell to almost 1.1 billion.

UPbit dropped by 5.5 billion XRP, but had a sudden turnover and increased the uncertainty around the Ripple coin.

Binance In addition, it fell to 2.86 billion to approximately 2.23 billion with a lack of approximately 630 million XRP. On BybitReserves decreased by 110 million XRP.

This was an equivalent decrease in reserves of 340 m to 229.7 m tokens. Bitfinex also caused a decrease in the XRP level, where the tokens dropped by 6 m between 64.5 to 58.5 m.

Source: Cryptoquant

These decreases indicated withdrawal of XRP institutions such as ETF, dividend funds and payment companies. They probably intend to store funds with custody services or use them in settlement.

UPBITY reserve, which has begun, has already begun to fill some measures, suggesting that this could be subject to a certain settlement.

Although these actions may indicate institutional accumulation, in the short term they showed liquidity in exchange, but this can increase volatility.

Why could XRP ETF be close to

In addition to downloading the startup MVDApp from the Vanek It has increased the possibility of XRP ETF, indicating more intense institutional activity.

This step was considered a harbinger of the ETF plumbing installation that potentially laid the foundations to cause the ripple in the regulated club.

In addition, Futures XRP and Micro XRP have become active because they were running 19 May.

The CME Group observed that Altcoin had become one of the best monitored assets during this time during the course.

Increasing interest of institutional and retail merchants pointed out the growing need for regulated derivatives with a structured exposure.

However, the sentiment was still divided accordingly The data of the prophet of the market. The meter showed that the crowd was optimistic with 1.94, because the score reflecting the bull’s view.

The intelligent sentiment of money on the other side was still on the negative side with the number standing at -1.30. This indicated a conservative mood among informed investors.

Source: Prophecy on the market

This disconnection has pointed to the lack of changing how the ripple can walk after a short -term horizon, although the ETF story still builds with increased institutional stimuli and increased demand in futures.

Source link