Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The XRP price is traded for $ 2.22 with neutral bias, despite a smaller 0.58% drop in the last 24 hours. XRP/USD continues to trade a critical level of $ 2.20 support, strengthened by Ripple’s aggressive pressure into traditional financing. The company recently applied for the US National Bank Charter at the Currency Administrator (OCC) and is also looking for the main account of the Federal Reserve.

If these movements were successful, they could integrate the ripples directly into the US payment infrastructure-prepaid development for crypto entity. The news has revived optimism among traders who look at a possible long -term increase of $ 10.

Meanwhile, institutional sentiment improves, driven:

These indicators strengthen the solid basic background on the XRP, although the markets of cryptocurrencies remain in a state of careful consolidation.

The XRP demand between institutions is growing despite macro uncertainty. Ripple’s continuing involvement with regulatory bodies, including its location for CBDC, has made the asset the best applicant for ETF consideration.

Traders and analysts point to a scenario in which ETF approval, combined with regulatory clarity and Ripple potential US Banking LicenseIt could move XRP towards a $ 10 brand – a level that was once considered speculative, but increasingly discussed.

While the immediate journey to $ 10 is not guaranteed, many from the market point of view are coped with traditional financing as a catalyst that can gradually close the gap.

From a technical point of view, XRP remains well supported. The two-hour chart shows the price respecting the growing trend line from the low 23 June, with 50-SMA ($ 2,2281) and 100-SMA ($ 2,2079) being a critical support zone.

Prediction Price XRP And its price measures have been tightened into a wedge near $ 2.23, a level of resistance that has been tested several times, but has not yet been broken. The candlestick formations are neutral to indecisive, including the turntable peaks, signaling the volatility compression.

If Bulls manages to escape over $ 2.2340 to a substantial volume, the XRP could quickly target $ 2.2822 and $ 2.3400. On the contrary, a break below $ 2.20 can invite a pullback to $ 2.147 or even $ 2.084.

Settings XRP store – escape in production:

With the deepening of the institutional alignment of Ripple and the price support, XRP remains one of the most monitored altcoins in 2025.

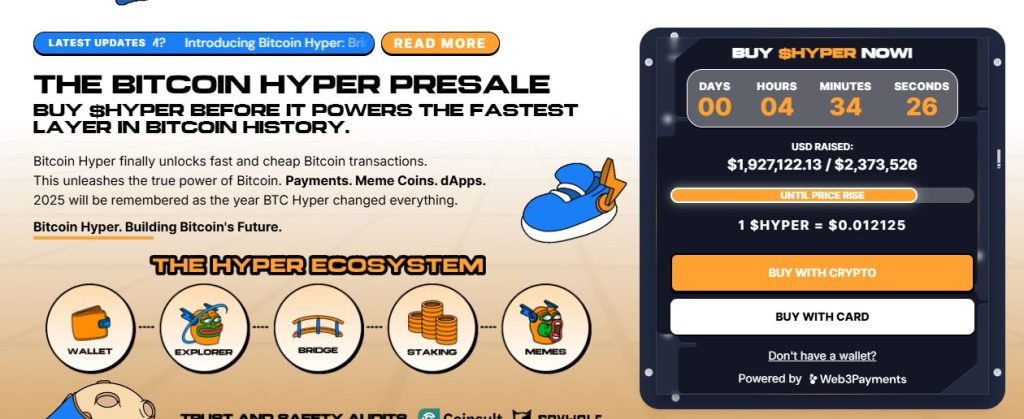

Bitcoin Hyper ($ Hyper)The first Bitcoin native 2 driven by the Solana virtual machine (SVM), exceeded $ 1.90 million in its public pre -platform, with $ 1,922,122 being increased from the target of $ 2,373,526. The token is a price of $ 0.012125, with additional levels expected within hours.

Bitcoin Hyper, designed to combine the security of bitcoins with the velocity of the Solana, allows fast, cheap intelligent contracts, DAPPS and MEME coins, all with a trouble -free BTC bridging. The project is audited by Consult and created for scalability, trust and simplicity.

The Golden Cross Meme attraction and real usefulness caused Bitcoin Hyper a candidate for layer 2.

Contribution Price prediction of XRP: Despite the recent slip with Ripple’s Institutional Push targets $ 10 – what to watch He appeared for the first time Cryptonews.