Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Per SightX

If you’ve worked in the insight field for a long time, you’re probably familiar with conjoint and maxdiff analysis. They are widely used in market research, most often for testing products and messages.

And while both can help you better understand what consumers value most about your product or service, each has a unique approach and output that can be beneficial depending on your use case.

So today we’re going to explore what each of these experiments can help you achieve, how they’re similar, how they’re different, and what you should choose for your specific use case!

Subscribe to receive Research Tool Radar and essential updates via email from Insight Platforms.

Before we dive in, let’s cover a few terms we’ll be using in this article:

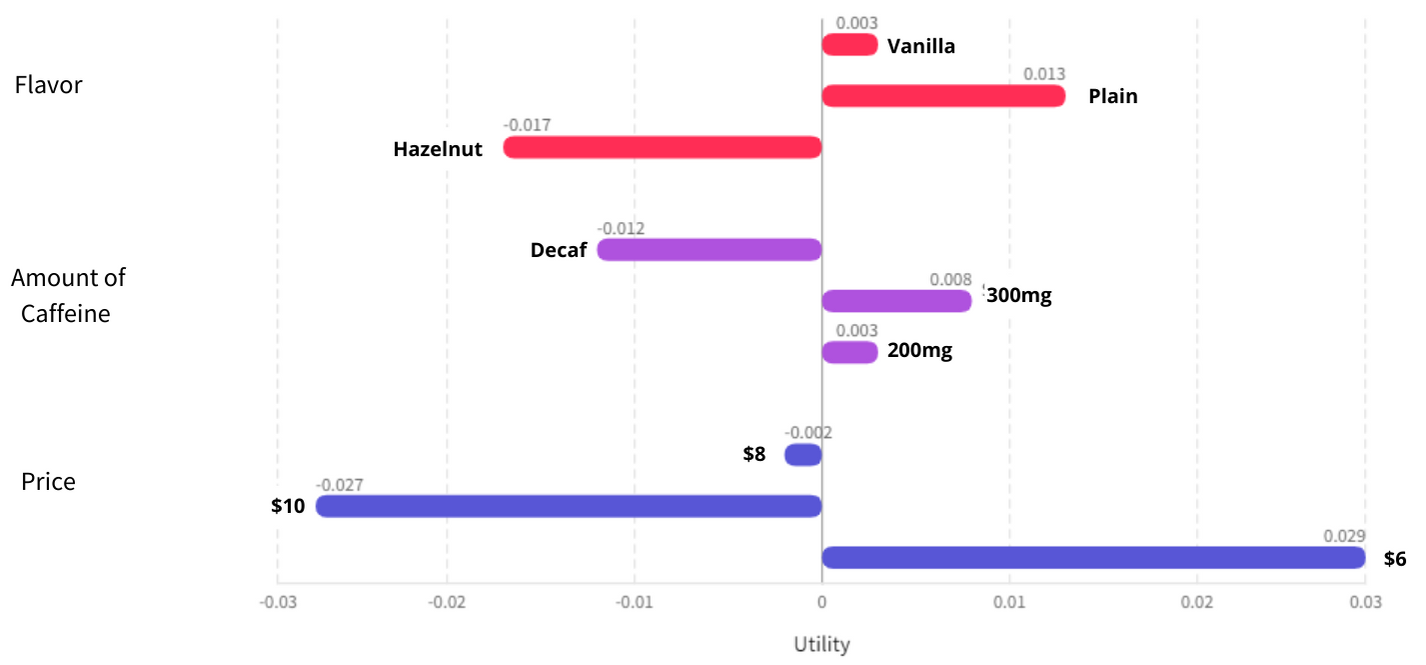

Attributes– Also known as product or service features. These are the aspects of your offer that will be evaluated in a maxdiff or conjoint analysis. For example, the attributes of a prepackaged cold beer might be price, taste, package sustainability, or caffeine content.

Levels– These are simply options that apply to each attribute you will be testing. Continuing the example above, the levels of our flavor attribute can be plain, vanilla, or hazelnut.

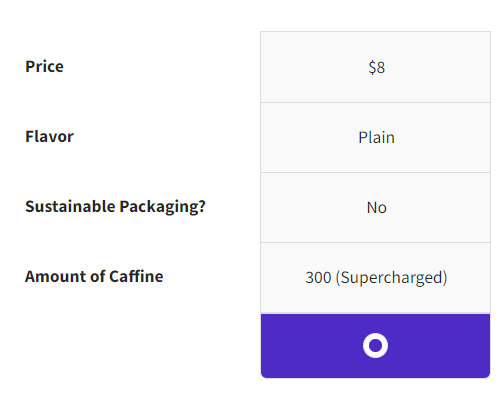

Profile or card– This is a hypothetical product (or service) offer generated during a joint experiment. It’s the total package of your attributes with random levels displayed. Below is a sample profile for our cold drink:

In market research, conjoint analysis is a technique used to measure the value of your product features– individually and in a package.

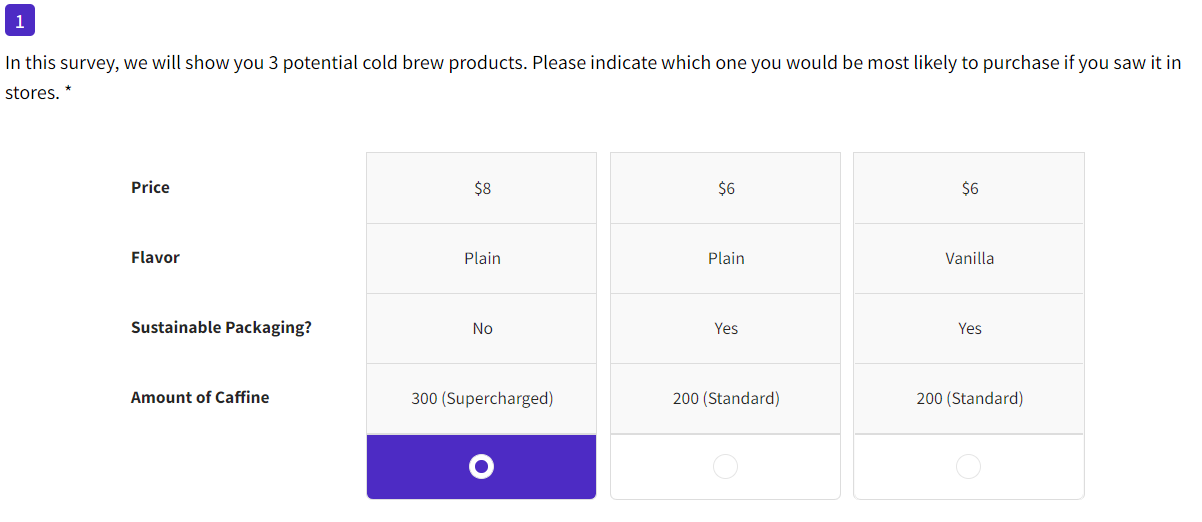

It does this by giving respondents a choice between 2-3 profiles, each with the same attributes but with random levels. Using our cold beer; a conjoint analysis question examining cost, packaging sustainability, taste, and caffeine content would look something like this:

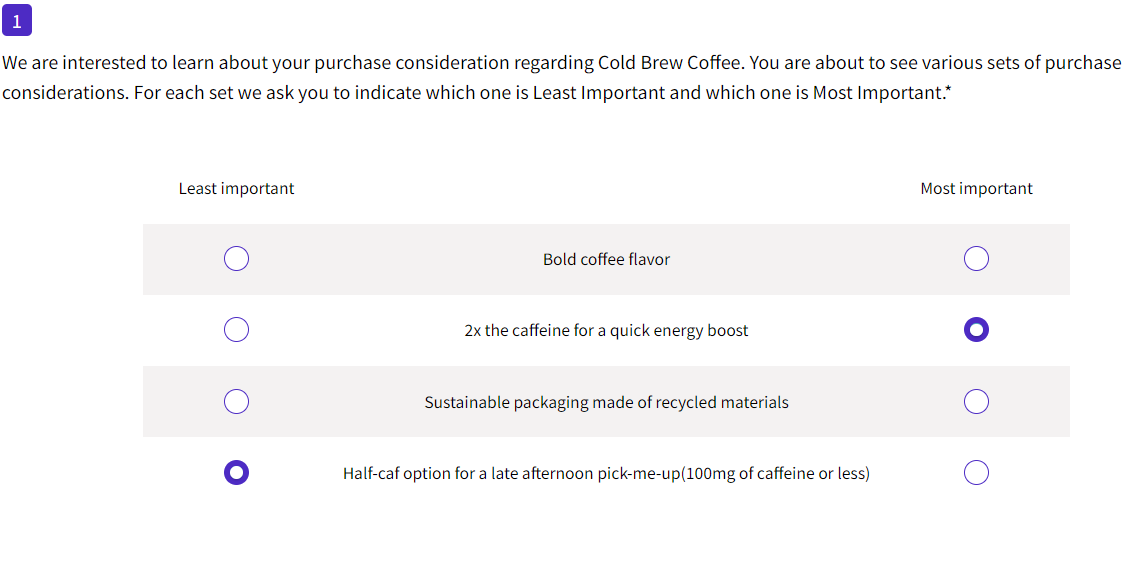

On the other hand, MaxDiff analysis allows respondents to quantify their preferences by rating your product’s attributes as least or most important to them. A sample MaxDiff question exploring similar attributes of our cold brew might look something like this:

Both Conjoint and MaxDiff analysis force respondents to make trade-offs, simulating a real-world purchase decision. While each experiment has its own way of doing this, both will give you better insight into which attributes are most important to your audience.

MaxDiff’s output will show you the order of your attributes from best to worst. This gives you a quick and easy way to understand which individual features are most valuable to consumers and which are least important.

.png)

On the other hand, the result of the joint analysis will not only show you the importance of each attribute, but also the popularity of each level within your attributes. Ultimately, this will help you better understand the optimal package to capture the most market share.

So the next time you’re trying to evaluate which methodology is right for your use case, just think about your goals:

IF you want to better understand the individual attributes of your product, we suggest MaxDiff.

Alternatively…

IF you are interested in finding the best overall package of features for your product, we suggest a match.

And if you need a little guidance to get started with any of these techniques, see our blog on conjoint analysis.