Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

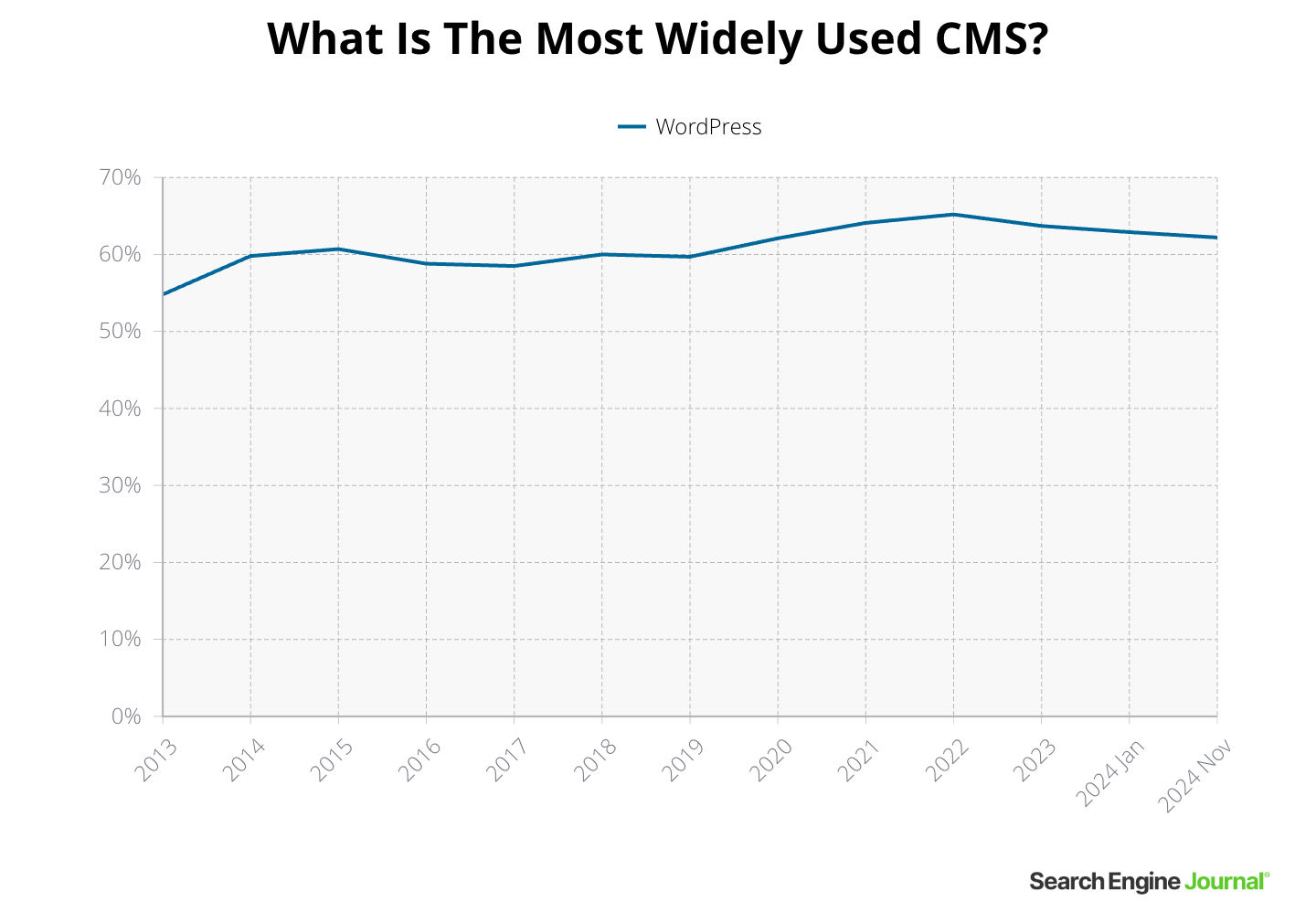

WordPress has held a dominant share of the content management system (CMS) market since it was launched in 2003.

Currently, the popular platform stands at 62.2% market share, according to W3Techs, which offers the most reputable and reliable data source. But in the last two years, WordPress market share has started to decline for the first time.

In this report, you’ll learn about the size of the CMS market, how it’s evolved over the past decade, how different content management systems stack up against each other, and why it matters to someone working in SEO.

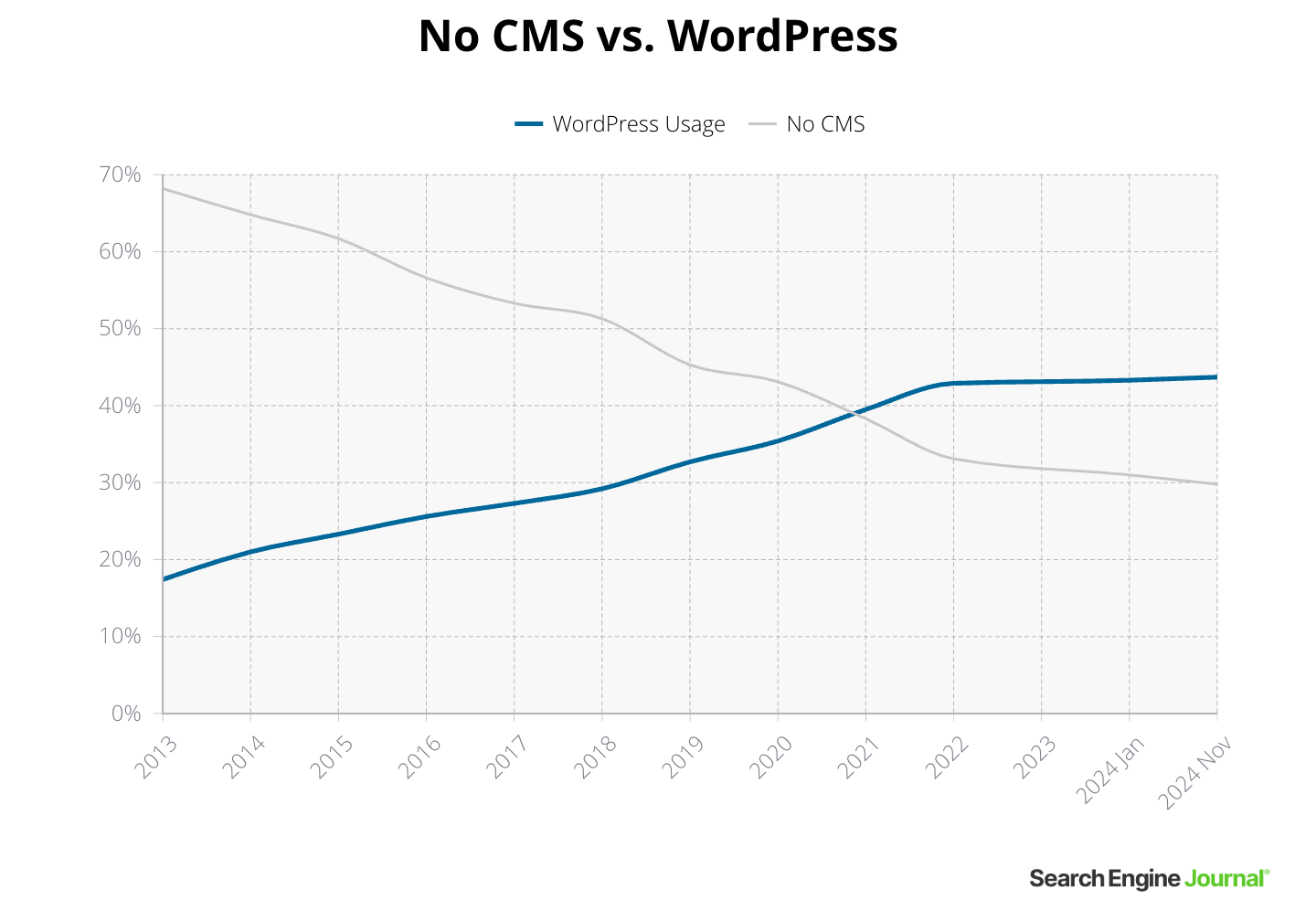

According to W3Techs, 70.2% of websites have a CMS, and Netcraft reports HRK 1.13 billion live website.

From this we can assume that the current market size for content management systems is approximately 793 million websites.

| CMS (from November 2024) | Started | Type | Market share | Usage | |

|---|---|---|---|---|---|

| No CMS | 29.8% | ||||

| 1 | WordPress | in 2003 | Open source | 62.2% | 43.7% |

| 2 | Shopify | in 2006 | SaaS | 6.6% | 4.6% |

| 3 | Wix | in 2006 | SaaS | 4.5% | 3.2% |

| 4 | Squarespace | in 2004 | SaaS | 3.1% | 2.2% |

| 5 | Joomla | in 2005 | Open source | 2.3% | 1.6% |

| 6 | Drupal | in 2001 | Open source | 1.3% | 0.9% |

| 7 | Adobe Systems (Adobe Experience Manager) | in 2013 | Open source | 1.2% | 0.9% |

| 8 | Webflow | in 2013 | SaaS | 1.1% | 0.8% |

| 9 | PrestaShop | in 2008 | Open source | 1.0% | 0.7% |

| 10 | Google systems (Google pages) | in 2008 | Online application | 0.9% | 0.6% |

Data from W3TechsNovember 2024

*Graphs are separated due to dominance of WordPress market share.

WordPress has held a dominant market share almost since its launch in 2003.

From 2013 to 2022, it experienced a strong growth of 148%. WordPress then peaked with a market share of 65.2% in January 2022, but has started to decline by nearly 5% over the past two years.

Between 2023 and 2024:

Screenshot from W3 Techs.com, November 2024

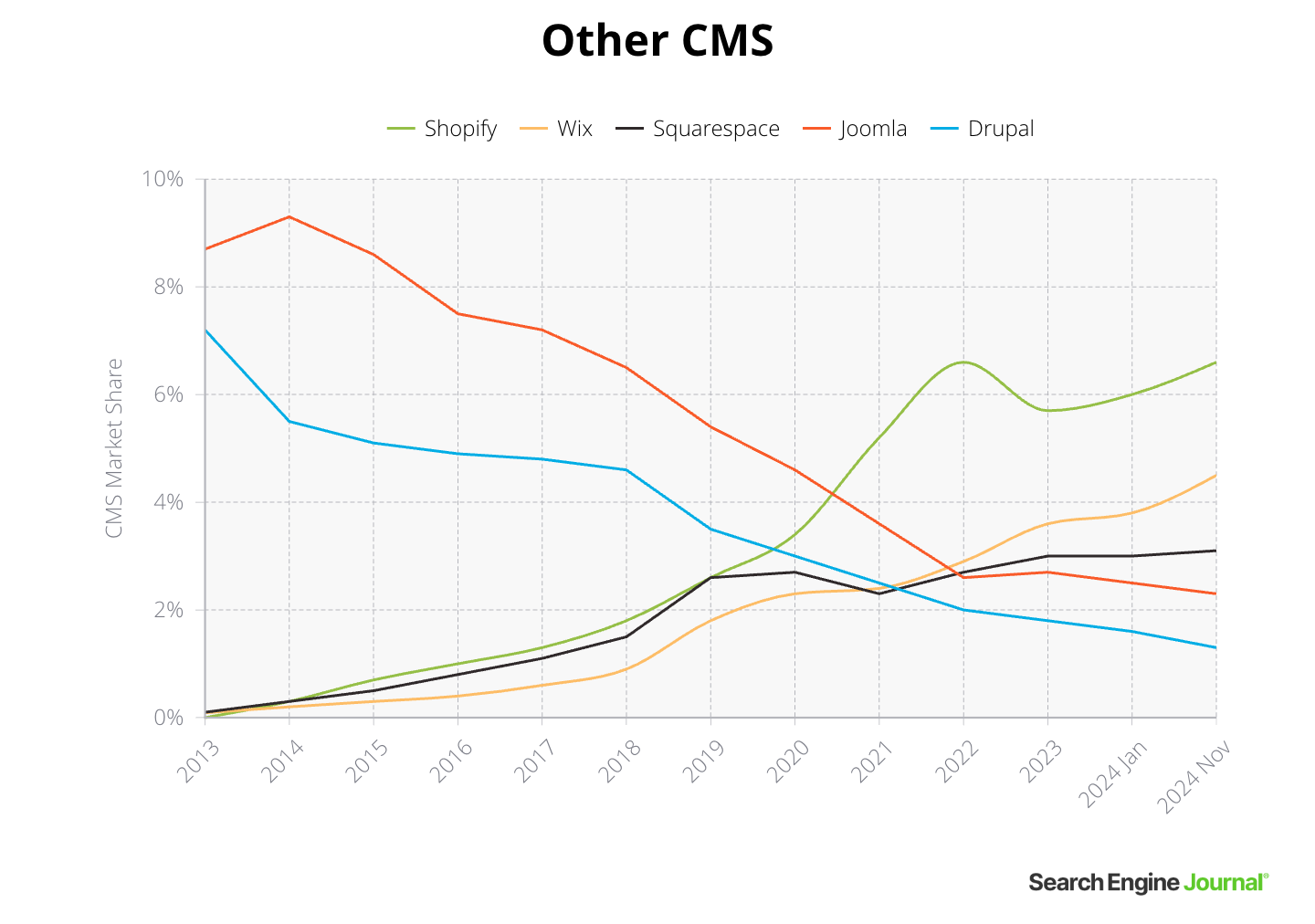

Screenshot from W3 Techs.com, November 2024In 2013, Joomla and Drupal held 15.9% of the CMS market share, but fell to 3.6%.

This decline saw them fall from positions 2 and 3 to 5 and 6, while Wix and Squarespace rose to finally replace them in 2022.

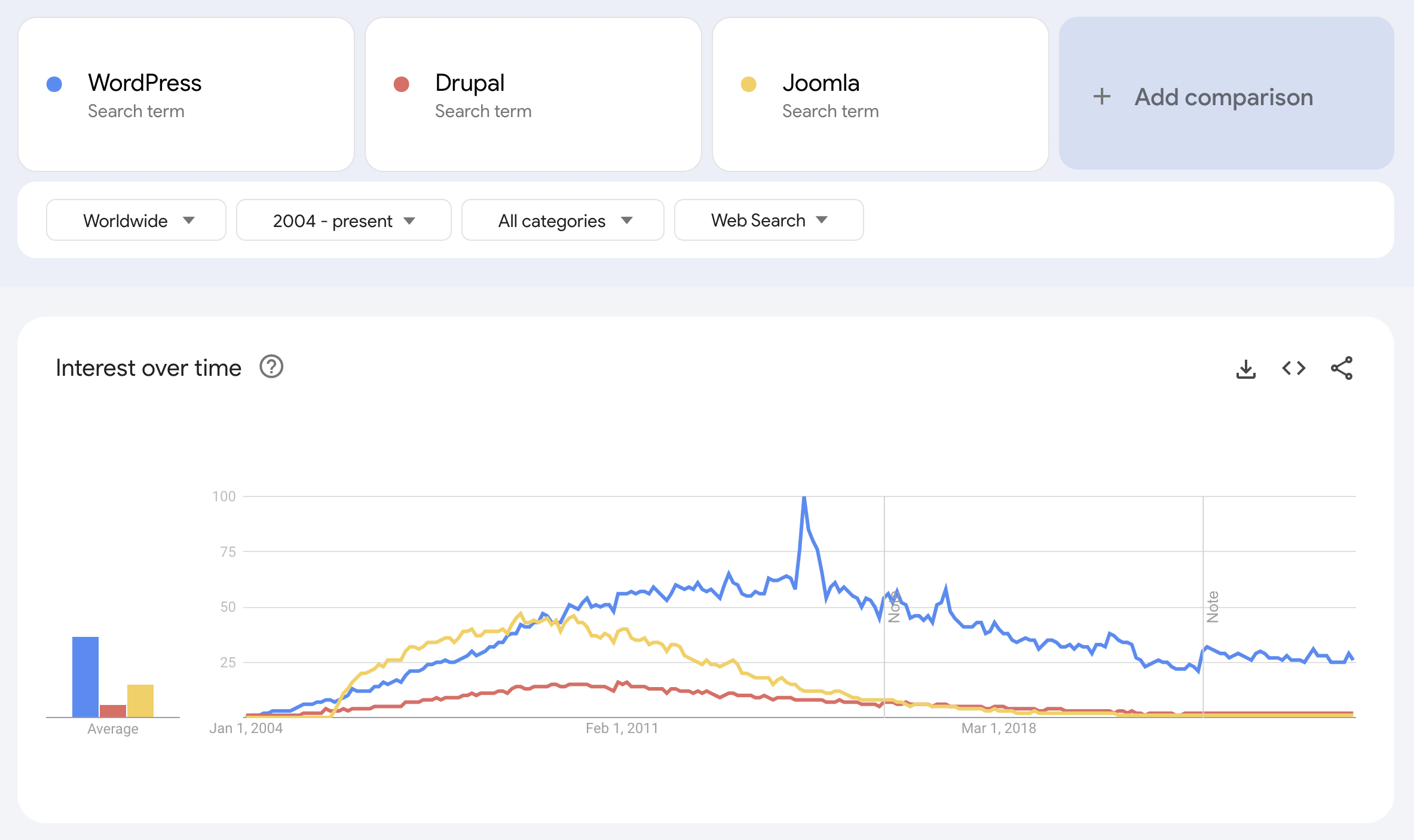

That’s quite a drop for Joomla, which may not have had the same market share as WordPress, but by in 2008had higher search interest, according to Google Trends.

Screenshot from Google Trends, November 2024

Screenshot from Google Trends, November 2024Why have these popular content management systems regressed so much?

This is most likely due to the strength of third-party support for WordPress with plugins and themes, making it much more affordable.

The growth of website builders such as Wix and Squarespace, shows that small businesses want a more easily managed solution. And they started nibbling the market share from the bottom.

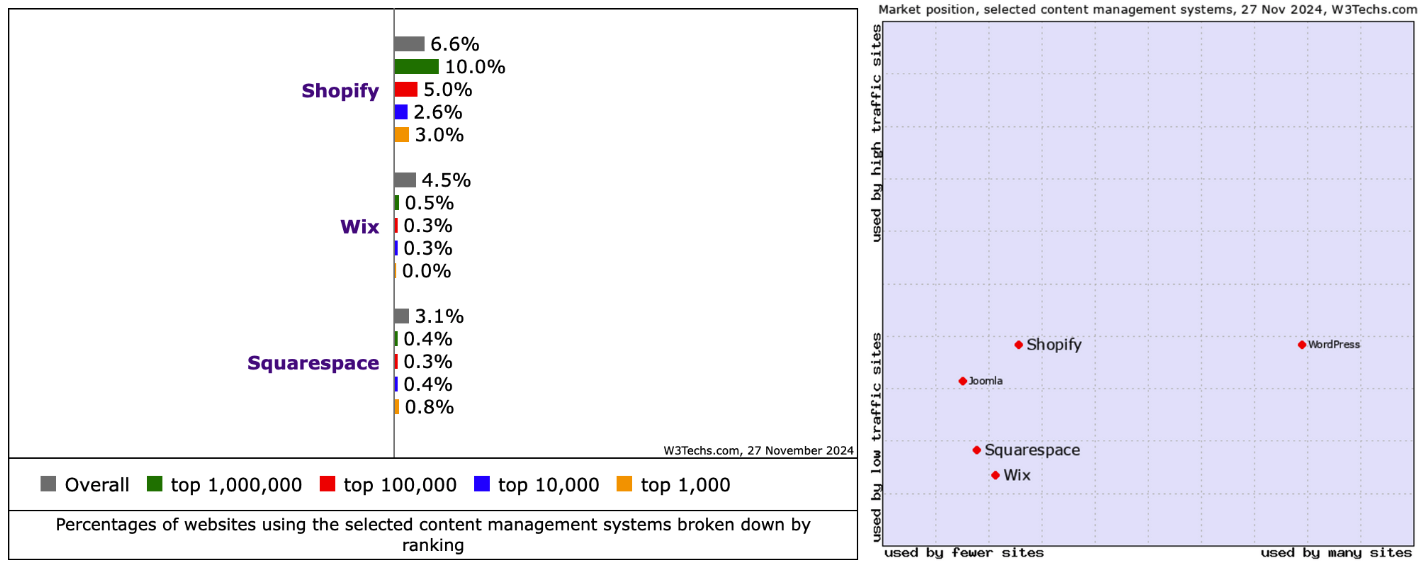

Screenshot from W3 Techs.com, November 2024

Screenshot from W3 Techs.com, November 2024If we look at website builders, their growth is a strong indicator of where the market could go in the future.

From 2023 to 2024:

When we compare WordPress’ 5% decline over the past year to other players, we have to ask ourselves why is this happening?

SaaS website builders like Wix and Squarespace require no coding skills and offer a hosted website that makes it more affordable for small businesses to quickly get a web presence.

There is no need to arrange a hosting solution, install a website and set up your own email. Web Builder does all that neatly for you.

WordPress is not known as a complicated platform to use, but it does require some coding knowledge and an understanding of how websites are built.

On the other hand, a website builder is a much easier route to market, without having to understand what’s going on behind the scenes.

Consider that during the pandemic, a large portion of the population worked from home, which led to greater interest and attention to how online could be a source of income.

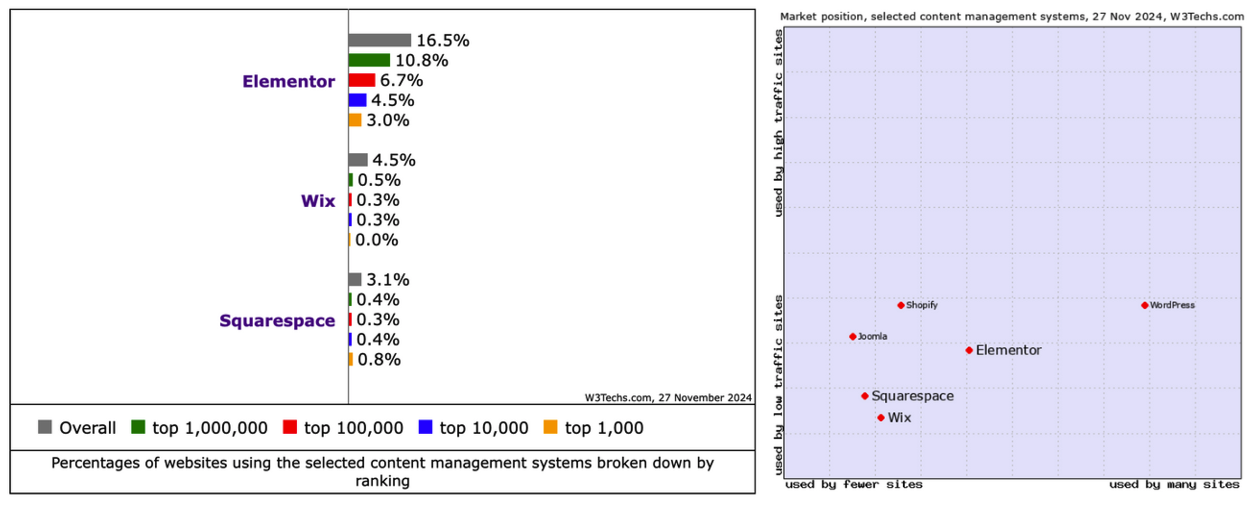

Elementor is a WordPress-based website builder that has a 16.5% market share and uses 11.6% of all websites.

Screenshot from W3 Techs.com, November 2024

Screenshot from W3 Techs.com, November 2024It also has significantly more market share than Wix and Squarespace combined.

However, since it is a third-party plugin and not a CMS, it is not listed in the Top 10 CMS above.

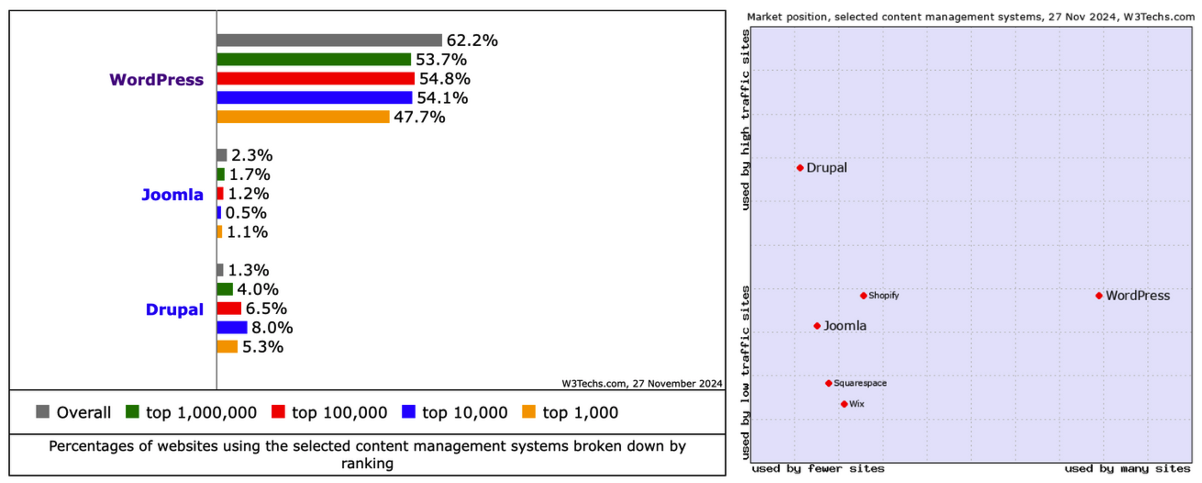

If we compare the amount of traffic with the number of CMS, we can see that WordPress in the golden ratio, above and to the right, is clearly favored by sites with more traffic.

Joomla fits the niche of fewer installs but more high-traffic websites, indicating that more professional websites are using it.

Squarespace and Wix are on the left and bottom, pointing out that they are installed in fewer places with less traffic.

This is a strong indication that they are used more by small websites and small businesses.

Elementor bridges the gap between the two and has the weight of WordPress market share, but is used by sites with less traffic.

There is a growing appetite for drag-and-drop, plug-and-play solutions that make a web presence accessible to everyone. This is an observation area.

Screenshot from W3Techs, November 2024

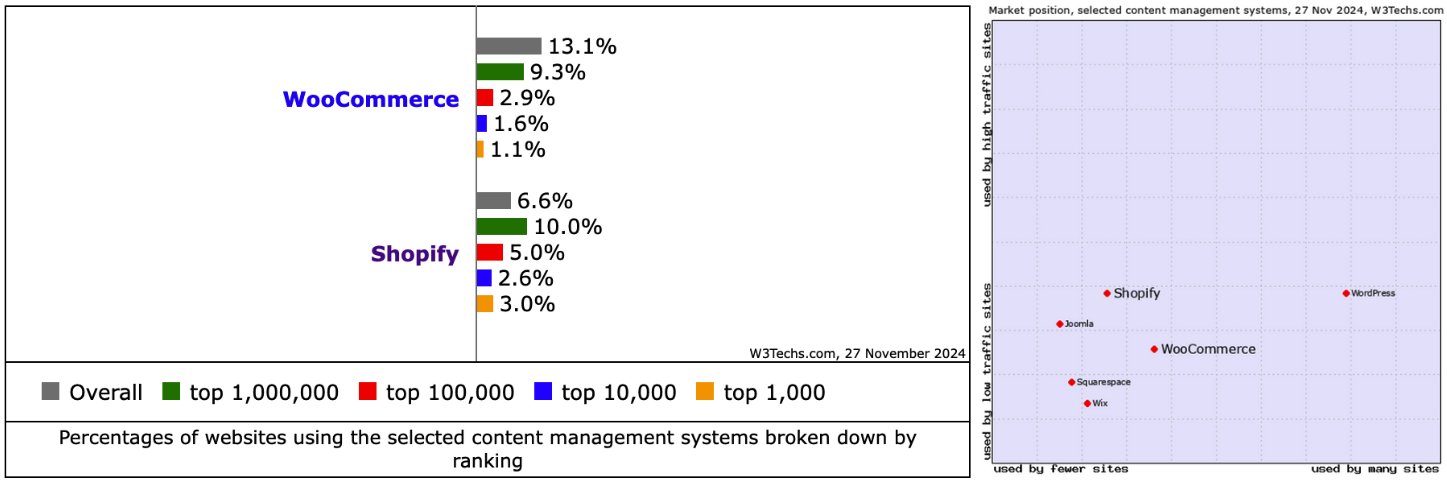

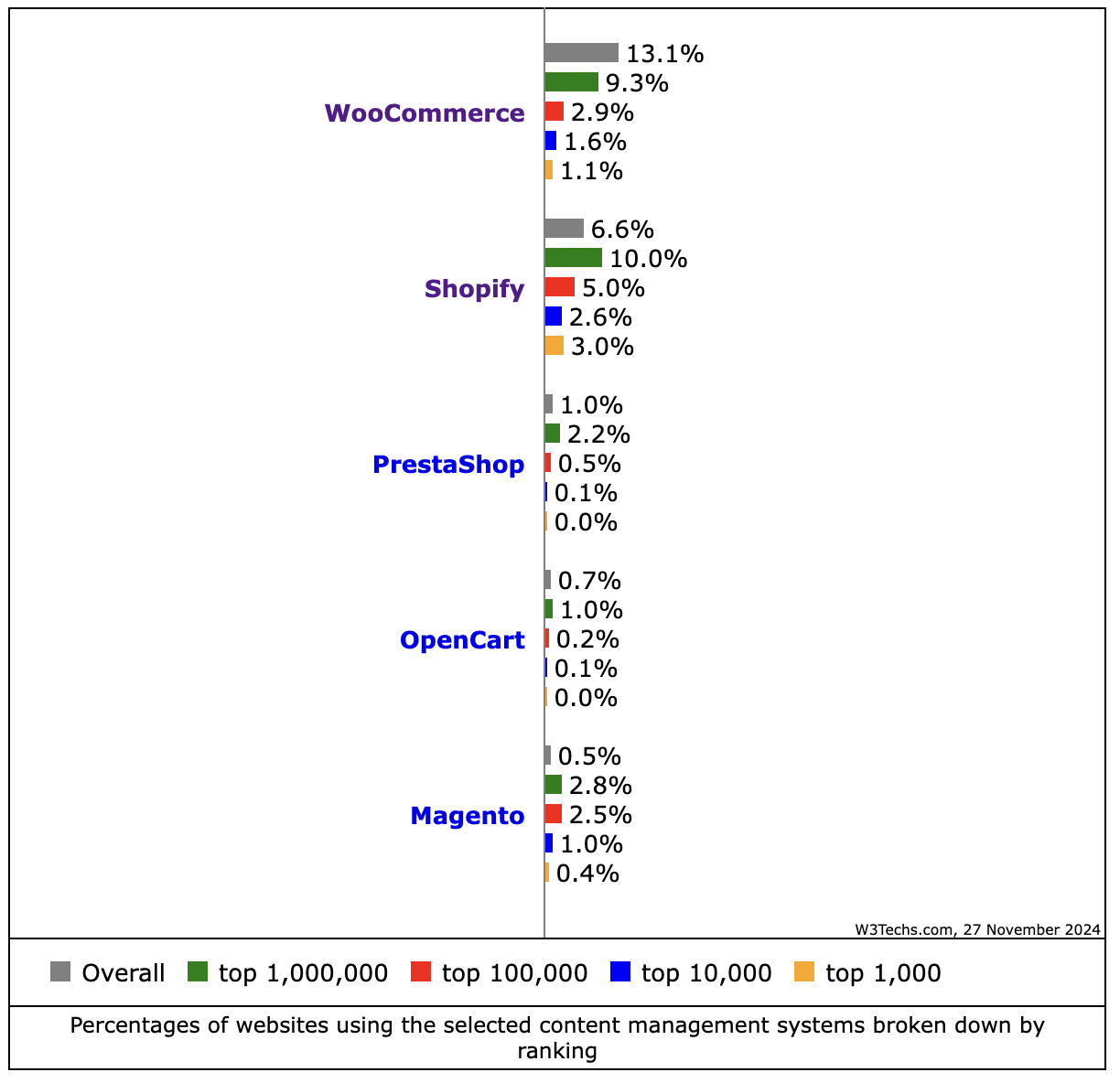

Screenshot from W3Techs, November 2024The e-commerce CMS space echoes a pattern similar to that of website builders.

Technically speaking, WooCommerce is not a stand-alone CMS, but a WordPress plug-in – which is why it doesn’t appear in the Top 10 CMS data table.

However, it is crucial to the e-commerce space, so it is worth considering and mentioning.

9.2% of all existing websites uses WooCommerce.

Looking at the distribution, we can see a clear pattern emerging. Compared to other e-commerce CMS platforms, WooCommere is dominant.

It has a higher market share than its competitors combined: Magento + OpenCart + PrestaShop + Shopify = 8.8% market share.

Screenshot from W3Techs, November 2024

Screenshot from W3Techs, November 2024Smaller sites might favor WooCommerce, but it has the weight of a WordPress platform for market access and, therefore, more installs – similar to Elementor.

Shopify has a larger market share, but traffic levels are similar to WordPress.

Shopify saw growth during the pandemic, up 52.9% from 2020 to 2021 and then 26.9% from 2021 to 2022 – far more than any other platform. It then retreated in 2023, but returned in 2024 to the same market share as 2022.

WordPress maintains its dominance in the CMS market share, but website builders such as Wix, Squarespace and Shopify are on the rise, which shows where the market growth lies, especially for small businesses.

If more small businesses are switching to website developers, understanding the limitations and intricacies of these SEO platforms could be a competitive advantage.

Shopify is installed on 4.6% of all websites (not just CMS websites) – a total potential market of 51.98 million websites.

With increasing market share, specialized in Shopify SEO could be a strategic move for an SEO specialist.

Similarly, specializing in Wix and Squarespace is a way to differentiate yourself from the competition.

WordPress may be dominant now, but that also means that many other people service that specific CMS.

Aligning with a more niche CMS can be a strategic move for new client opportunities.

More resources:

All data collected from W3Techs, November 2024unless otherwise noted.

W3Tech samples its data from Alexa top 10 million and Tranco top 1 million. Websites with no content or duplicate websites are excluded. Data source restrictions mean that Tumblr and WordPress.com hosted sites are not included, as the data collection does not count subdomains as more than one site.

Featured Image: Genko Mono/Shutterstock